Inventory carrying cost is the total price tag for holding onto unsold stock. This isn't just about paying warehouse rent. It's the whole cocktail of expenses: the cost of capital tied up in products, storage fees, insurance, and the ever-present risk of your inventory becoming obsolete. All in, this typically adds up to 20% to 30% of your inventory's total value.

Ever stared at your sales numbers, which look great on paper, but then wondered why your bank account doesn't seem to agree? Many Shopify and D2C founders get tripped up by a silent profit killer lurking in their warehouses: inventory carrying cost. This isn't just another line item on a spreadsheet; it's the cumulative cost you pay for every single product that sits on your shelves, waiting for a customer.

Think of it as the money your inventory costs you just by existing. Every day an item goes unsold, it’s quietly accumulating expenses that eat away at its potential profit margin. For any D2C brand, getting a handle on this number is non-negotiable.

If you ignore these holding costs, you're flying blind and likely making some costly business decisions. Without a clear picture of what it truly costs to store your goods, you might find yourself:

In short, a high inventory carrying cost is a massive red flag for inefficiency. It's a clear signal that your capital is trapped on a shelf instead of being put to work growing your business. Mastering this metric is one of the single most effective ways to boost your bottom line without having to chase more sales.

This guide will demystify what inventory carrying cost actually is and how it's impacting your brand. We'll break down its core components, show you how to calculate your own percentage, and lay out actionable strategies to bring those expenses down. By turning this hidden liability into a competitive advantage, you can build a far more resilient and profitable operation.

Let's start by digging into what really makes up this number.

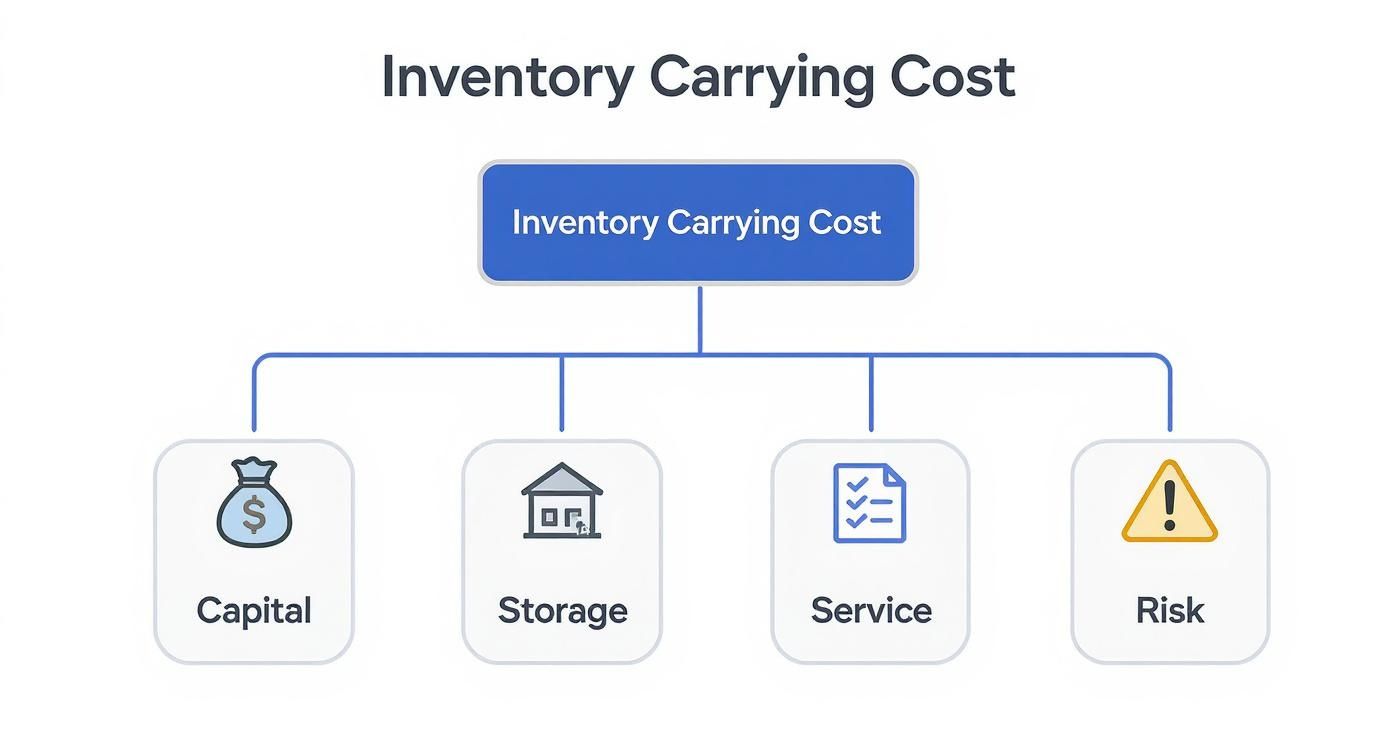

To get a handle on your carrying costs, you need to understand the different pieces of the puzzle. The table below breaks down the four main components that contribute to your total holding expenses.

| Cost Component | What It Covers | Common Examples |

|---|---|---|

| Capital Cost | The cost of money tied up in inventory. | Interest on loans for stock, opportunity cost (what the money could have earned elsewhere). |

| Storage Cost | Expenses related to physical warehouse space. | Warehouse rent, utilities (heating, cooling), handling equipment, security staff. |

| Service Cost | Costs for managing and protecting your inventory. | Inventory management software (WMS), insurance premiums, physical stock counts, taxes. |

| Risk Cost | The financial risks associated with holding stock. | Product obsolescence, shrinkage (theft/damage), devaluation, spoilage. |

Each of these components represents a real cost to your business. When you add them all up, you start to see the true price of letting inventory sit idle.

To really get a grip on inventory carrying cost, you have to break it down. It’s not just one big, scary expense; it’s a number built on four distinct pillars. Each one represents a different way your unsold inventory is quietly draining money from your business, often in ways that aren't immediately obvious on a balance sheet.

Think of your total carrying cost like a bar tab that keeps growing the longer your products sit on the shelf. Each of these four pillars is like a different drink being added to your bill—some are cheap, some are expensive, but they all add up. Let's break them down one by one.

This graphic shows how these four pillars come together to form your total inventory holding expense.

As you can see, capital, storage, service, and risk are the foundational elements of your overall carrying cost, and each one packs a punch.

This is usually the biggest and most overlooked component. It’s the opportunity cost of having your money tied up in physical products. Every dollar you spend on inventory is a dollar you can't use for something else—like a new marketing campaign, product R&D, or even just earning interest in the bank.

Imagine you have $50,000 tied up in slow-moving skincare products. If you could have invested that same $50,000 into a marketing push that generated a 15% return, your capital cost is $7,500. It’s the silent, invisible expense of "what could have been." This pillar also includes any interest you’re paying on loans used to buy that inventory in the first place.

This pillar is the most tangible one. It’s the direct, out-of-pocket cost of physically housing your products. While the warehouse rent is the obvious line item, the true cost goes much deeper than that.

Your total storage costs include:

For a D2C brand selling artisanal chocolates, for example, climate-controlled storage isn't a luxury; it's a non-negotiable. That extra utility bill is a direct part of their storage cost.

The scale of these costs is staggering. In the United States alone, inventory carrying costs soared to an estimated $302 billion, a 13.2% year-over-year increase. This spike was driven by rising interest rates, higher warehousing fees, and a 5.7% jump in the retail inventory-to-sales ratio as businesses held more stock amidst supply chain uncertainty. You can explore more data on rising U.S. logistics costs on Tradlinx.com.

This pillar covers all the administrative and operational expenses needed to manage and protect your inventory. Think of these as the essential services that keep your inventory system running smoothly and securely.

These costs typically involve:

Without these services, your inventory would be an unmanaged, uninsured, and unaccounted-for mess, leading to much bigger financial headaches down the road.

Finally, we get to the most volatile pillar: inventory risk. This category covers the potential for your inventory to lose value for reasons mostly outside your control. It’s the financial gamble you take by holding physical goods.

The main risks include:

Each of these four pillars—Capital, Storage, Service, and Risk—contributes to that one critical metric. Once you understand how each one impacts your business, you can start finding specific areas to improve and turn a major liability into a source of operational strength.

Knowing what makes up your carrying costs is half the battle. The real magic happens when you calculate your own number. You don't need an accounting degree for this; it's a straightforward process that gives you a vital health metric for your entire operation.

This calculation turns a vague feeling of "storage is expensive" into a hard percentage you can actually track, manage, and shrink over time. It's the first step in transforming a hidden expense into a serious competitive advantage.

The most common way to figure this out is to express your carrying cost as a percentage of your total inventory value. This percentage tells you exactly how many cents you're spending to hold each dollar's worth of inventory for a full year.

The formula is pretty simple:

Carrying Cost % = (Total Holding Costs / Average Inventory Value) x 100

Let's quickly break down the two parts of that equation so you know exactly what numbers to pull.

Once you have those two figures, you can plug them into the formula. What you get is a powerful, at-a-glance metric for your inventory efficiency.

Let's see how this formula plays out for two different D2C businesses.

Imagine a small Shopify store called "Crafty Candles Co." that sells handmade candles. They sat down and ran the numbers for the past year:

Now, they just plug these into the formula: ($4,000 / $20,000) x 100 = 20%

This means for every dollar of candle inventory Crafty Candles Co. holds, it costs them 20 cents a year. For a small business, that's a pretty solid number.

Now let's look at a bigger D2C brand, "Urban Activewear," which deals with more complex and seasonal stock.

Here’s their calculation: ($150,000 / $500,000) x 100 = 30%

Urban Activewear's higher carrying cost makes sense. It’s driven by the greater risk of fashion going out of style and higher capital being tied up in stock. Managing this 30% is crucial, and a big part of that is avoiding overstocking. For a deeper dive on that, you can learn how to calculate safety stock in inventory to protect against stockouts without bloating these costs.

As a rule of thumb, a healthy range for carrying costs is between 20% and 30%. If your number creeps above that, it's a clear signal that there's an opportunity to tighten up your operations and boost your bottom line.

Okay, so you've calculated your inventory carrying cost. That's a huge first step. Now for the part that actually boosts your bottom line: shrinking that number. This isn't about slashing budgets indiscriminately. It's about building a smarter, leaner operation that turns what was once a liability into a real competitive edge.

When you lower your holding expenses, you free up cash, fatten your margins, and make your business far more resilient. The best part? You can start putting these strategies into practice today, no matter the size of your brand. Let's dig into some of the most powerful tactics for D2C merchants.

The most straightforward way to cut carrying costs is to simply stop buying too much stuff. It sounds obvious, but excess inventory is the number one driver of high storage, capital, and risk expenses. Improving your demand forecasting helps you shift from reactive guessing to proactive planning, making sure you only stock what your customers are actually likely to buy.

Forget relying only on last year's sales data. Modern forecasting brings more to the table:

Getting your predictions right means less cash is tied up in products just sitting on a shelf, racking up costs day after day.

The whole philosophy behind lean inventory management is about eliminating waste—and in ecommerce, excess stock is one of the biggest forms of waste there is. Two well-known strategies can get you there.

The Just-in-Time (JIT) model is all about ordering goods from your suppliers only as you need them to fulfill customer orders. This can dramatically slash storage and capital costs because you're holding almost no backstock. The catch? JIT demands incredibly reliable suppliers and works best for brands with predictable demand. One hiccup in the supply chain can lead to frustrating stockouts.

Another fantastic approach is to calculate your Economic Order Quantity (EOQ). This formula is a game-changer because it helps you find the sweet spot for your purchase orders—the perfect quantity that minimizes both your ordering costs and your holding costs. To really master this, check out our guide on what is economic order quantity. It’ll give you the tools to strike that ideal balance.

How you organize your warehouse isn't just about being tidy; it directly hits your bottom line. A clunky, inefficient layout inflates labor costs for picking and packing, increases the chance of products getting damaged, and leads to wasted space. All of these add up, bloating your carrying costs.

A few smart optimizations can lead to major savings:

Think of these operational tweaks as strategic moves. They’re not just for organization’s sake—they’re designed to reduce handling time, minimize costly mistakes, and trim the labor portion of your storage costs.

Your suppliers are your partners in this. Building strong, collaborative relationships can open up new ways to lower your holding costs without ever having to compromise on product availability.

Start by trying to negotiate more favorable terms. Maybe that means getting more frequent, smaller deliveries instead of massive bulk orders that sit for months. You might lose a tiny bit on a bulk discount, but the savings on carrying costs often more than make up for it. You can also discuss better payment terms to improve your cash flow, which directly reduces the capital cost component of your holding expenses. A supplier who gets your business goals is far more likely to work with you.

This is more critical than ever, with logistics expenses on the rise. According to the Logistics Manager’s Index, inventory costs recently hit a historic peak with a reading of 78.4—the highest ever recorded. The report also points out that smaller firms are feeling the squeeze the most, which shows just how crucial efficient inventory management is for D2C brands. You can explore the full Logistics Manager's Index report for a deeper dive into these trends. By working hand-in-hand with your suppliers, you can build a more agile supply chain that’s better equipped to handle these rising costs.

Let’s be honest, traditional inventory methods are starting to show their age. Relying on last year's sales data or a simple "gut feeling" just doesn't cut it in today's fast-moving market. These old-school approaches are often the very reason merchants get stuck with the kind of overstocking that sends their inventory carrying cost through the roof.

This is where modern AI solutions come in. They completely change the game, moving your inventory management from reactive guesswork to proactive, data-driven precision. AI allows you to tackle the root causes of high holding expenses head-on. It doesn’t just glance at past performance; it dives deep, analyzing a huge range of complex variables in real-time—subtle market trends, competitor pricing, seasonal demand shifts, and even how your latest marketing campaign is performing.

The single biggest way AI helps slash carrying costs is through radically better demand forecasting.

Think of it this way: trying to predict the weather by only looking at what happened on this day last year is a recipe for disaster. You might get lucky sometimes, but you’d miss all the immediate, dynamic factors that actually determine if it will rain. That's traditional forecasting in a nutshell.

AI-powered demand forecasting, on the other hand, is like a sophisticated meteorological model. It crunches thousands of data points at once to deliver predictions with stunning accuracy.

This is what that looks like in action. Tociny.ai takes all that complexity and boils it down into a clear, actionable forecast.

The platform gives you a clean visual trend, so you can see what’s coming without needing a degree in data science.

This level of precision directly attacks the main cause of high carrying costs: ordering too much stuff. When you align your purchase orders with what customers are actually going to buy, you minimize the cash tied up in slow-moving stock and dramatically reduce your obsolescence risk. For a deeper dive, you can learn more about improving demand forecasting accuracy in our detailed guide.

Great forecasting is just the beginning. The real power comes when AI provides intelligent recommendations to fine-tune your entire inventory strategy. An AI engine can calculate the most efficient reorder points and order quantities for every single SKU in your catalog.

This keeps your stock levels lean but perfectly synced with customer demand. It’s the ultimate defense against both costly overstocking and profit-killing stockouts.

AI in Action: A D2C Brand Case Study Picture a direct-to-consumer fashion brand that was constantly fighting high carrying costs—often hitting 35% of their inventory value. They were regularly left with mountains of unsold seasonal apparel, forcing them into deep discounts that crushed their margins and inflated their risk costs.

After bringing an AI-powered inventory solution on board, everything changed. The platform's forecasting model accurately predicted a dip in demand for a specific jacket style, prompting the brand to slash their initial order by 40%. At the same time, it flagged rising interest in a new accessory, recommending they increase stock for that item.

The results were immediate and powerful:

- Capital Freed Up: Less cash was trapped in slow-moving jackets, which they could immediately reinvest into marketing the popular accessories.

- Storage Bills Reduced: With a leaner overall inventory, their monthly warehouse fees dropped significantly.

- Obsolescence Risk Minimized: They ended the season with almost zero dead stock, completely avoiding the need for those profit-destroying clearance sales.

In just six months, the brand cut its overall inventory carrying cost from 35% down to a much healthier 22%. This wasn't just an accounting win; it was a strategic pivot that made their entire operation more agile, profitable, and resilient.

You can’t afford to treat inventory carrying cost as just another line item on a spreadsheet. That's a rookie mistake, and it's a costly one.

Think of it this way: every dollar you have tied up in products just sitting on a shelf is a dollar you can't use for anything else. It's not funding your next marketing campaign, developing a new product, or even earning interest in the bank. It's just... sitting there.

When these holding costs get out of hand, they become an anchor, dragging down your entire business. They eat into your cash flow and choke out opportunities for growth. In the cutthroat world of D2C e-commerce, this kind of operational drag is exactly what separates the brands that scale from those that barely scrape by. Getting a handle on these costs isn't just good housekeeping; it’s a direct path to building a more resilient, profitable company.

Ignoring carrying costs isn't some abstract financial problem—it has real-world consequences. A few years back, when companies scrambled to front-load imports to dodge new tariffs, the Port of Los Angeles was completely overwhelmed. This tidal wave of inventory created a massive logjam, putting incredible pressure on warehouses and supply chains. The result? Holding costs shot through the roof. You can read more about this supply chain nightmare on SupplyChainDive.com.

By consciously defining, calculating, and then attacking these expenses, you're making a strategic decision to build a smarter, more scalable business. The goal here is to flip the script and turn your inventory from a liability into a dynamic asset that actively fuels your growth.

Ultimately, mastering your inventory carrying cost isn't just about shaving a few bucks off your warehouse rent. It’s about creating a leaner, more agile operation that can run circles around the competition and free up cash to reinvest where it actually matters.

We've walked through what inventory carrying cost is, how to crunch the numbers, and some smart ways to bring it down. But let's be real—theory is one thing, and running your D2C store is another. Here are some of the most common questions we hear from founders, with straightforward answers to get you on the right track.

There's no single magic number that fits every business, but for most D2C brands, you should be aiming for a sweet spot between 20% and 30% of your inventory's total value.

If you find yourself creeping above that 30% mark, it’s a big red flag. It usually means you're holding onto too much stock or your storage and management are less efficient than they could be. On the flip side, getting below 20% is a great sign—it often points to a lean, well-oiled operation.

Don't think of this as a one-and-done task. To get a truly useful picture of your business health, you should calculate your inventory carrying cost at least annually.

But if your brand is growing fast or you deal with a lot of seasonality (hello, holiday rush!), a quarterly review is a much better move. Checking in more often helps you spot trends early and make quick pivots to your inventory strategy. This prevents those costs from silently eating into your margins during your busiest seasons.

Key Takeaway: When you calculate it regularly, this metric transforms from a boring historical report into a proactive tool. It’s about staying ahead of problems before they take a real bite out of your profits.

By far, the most common pitfall is ignoring all the "hidden" costs. It's easy to just look at your warehouse rent and call it a day, but that’s only a tiny piece of the puzzle.

Here are the top three mistakes we see brands make all the time:

Ready to stop guessing and start making inventory decisions based on solid data? Tociny.ai uses AI to give you razor-sharp demand forecasts and clear, actionable recommendations. We help you slash carrying costs and seriously boost your profitability. Discover how Tociny.ai can optimize your Shopify store.

Tociny is in private beta — we’re onboarding a few select stores right now.

Book a short call to get early access and exclusive insights.