Imagine every single product on your shelves has a little timer attached to it, counting the seconds, minutes, and days until someone buys it. That timer is essentially your Days Inventory Outstanding (DIO). It's a core metric that tells you, on average, how many days your company holds onto inventory before it's sold and turned into cash.

Simply put, a lower DIO is almost always better. It's a sign that you're quick and efficient at converting stock into sales.

Think of your warehouse less like a storage space and more like a massive retail shelf. Every item sitting there has an invisible "sell-by" date. DIO measures how long, on average, a product sits on that shelf before a customer finally clicks "buy." This isn't just some stuffy accounting term; it’s a direct pulse check on your store's operational health and financial agility.

You might have heard of inventory turnover, which tells you how many times you sell through your entire stock in a year. DIO is just the inverse of that. It translates the "how many times" into a much more intuitive and actionable number: how many days each of those turns takes. That small shift in perspective makes it so much easier to understand what's really happening with your products.

The biggest, most immediate way DIO affects your business is through cash flow. Every unsold product represents capital—your hard-earned cash—physically tied up on a shelf. It’s money you can't reinvest into marketing, new product development, or any other part of your business that fuels growth.

A high Days Inventory Outstanding means your cash is trapped in unsold goods for longer. In effect, you're giving your own inventory an interest-free loan. Cutting your DIO frees up that capital, making your entire business more liquid and resilient.

A lower DIO means you're getting cash back into your bank account faster. This rapid conversion cycle is the lifeblood of your business, allowing you to reinvest quickly and build a much healthier financial foundation. A store that turns over its stock every 30 days will have dramatically more working capital than a competitor with a 90-day DIO, even if their sales numbers are identical.

Beyond the crucial impact on cash, getting your DIO under control has a ripple effect of benefits for your ecommerce store. When you truly understand this metric, you can:

Ultimately, mastering your Days Inventory Outstanding is non-negotiable if you want to scale a profitable online store. It's what moves inventory management from a frustrating guessing game to a strategic, data-driven process. Before we get into the formula, it’s critical to get a feel for why this all matters so much.

Calculating your Days Inventory Outstanding might sound like a job reserved for the accounting department, but the formula itself is surprisingly simple—and incredibly revealing. Think of it as the first step in moving from just guessing about your inventory needs to building a sharp, data-driven strategy.

At its core, the calculation is designed to answer one crucial question: "How long does my stuff sit on the shelf before someone buys it?"

Getting to your DIO number only takes three pieces of data that you almost certainly have on hand. The formula looks like this:

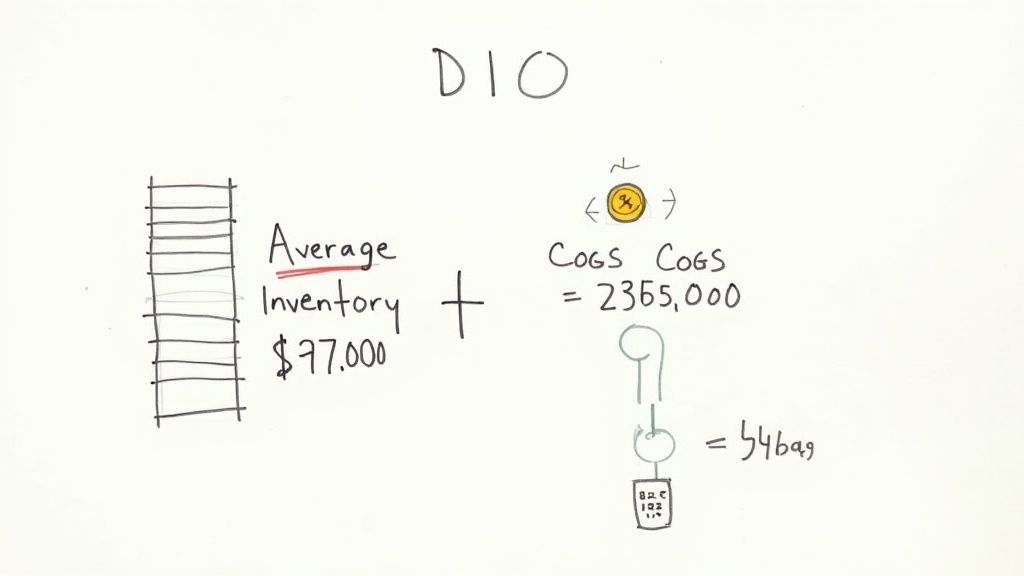

DIO = (Average Inventory / Cost of Goods Sold) x Number of Days in Period

This simple equation spits out a single number that tells you the average number of days an item hangs around in your warehouse before it’s sold. As a general rule, a lower number is better. It points to healthier cash flow and more efficient operations.

To get a number you can trust, it’s important to understand what each piece of the formula represents. Each variable tells a specific part of your inventory’s story, and finding them is easier than you might think, especially if you're on a platform like Shopify, which keeps this data in its reporting dashboards.

Here’s a quick rundown of each component and where you can typically find the numbers for your Shopify store.

| Component | Definition | Where to Find It (for Shopify stores) |

|---|---|---|

| Average Inventory | The average value of your stock over a specific period. It's calculated by adding your beginning and ending inventory values, then dividing by two. This smooths out any spikes or dips from big stock deliveries or flash sales. | Shopify Admin > Analytics > Reports. You'll need the "Inventory value" report for the beginning and end of your chosen period. |

| Cost of Goods Sold (COGS) | The direct costs tied to producing the products you sold. This includes things like raw materials and direct labor, but not indirect costs like marketing or rent. | Shopify Admin > Analytics > Reports. Look for the "Profit by product" or a general "Profit and Loss" statement. COGS is a standard line item. |

| Number of Days in Period | This is just the timeframe you're analyzing. It could be 365 for an annual review, 90 for a quarterly check-in, or 30 for a monthly snapshot. | You decide this based on the period you want to measure. |

Getting these three numbers is the hardest part, and as you can see, it's not very hard at all. Now, let's plug them into the formula.

Let's walk through a real-world scenario. Imagine you run a growing D2C brand on Shopify selling handcrafted leather bags, and you want to figure out your annual DIO.

First, you pull your numbers for the last fiscal year:

Here’s how you’d calculate your DIO, step by step:

First, find your Average Inventory: ($25,000 + $29,000) / 2 = $27,000

Next, plug everything into the DIO formula: ($27,000 / $243,000) x 365

Finally, solve the equation: (0.111) x 365 = 40.56 Days

Your Days Inventory Outstanding is 40.56. This means that, on average, it takes your business just over 40 days to sell a leather bag from the moment it hits your inventory.

This isn't just a random number; it's a vital financial metric that measures how efficiently you're turning inventory into cash. For more on inventory metrics, you can find a good overview on Taulia.com. With this single number, you now have a baseline—a starting point you can track, measure against, and actively work to improve.

After you’ve run the numbers and calculated your Days Inventory Outstanding, the next question is always the same: "Is my number good or bad?"

The simple—and maybe frustrating—answer is there's no magic number. A "good" DIO is completely relative. Trying to compare your business to one outside your specific niche is pretty much useless.

Think of it like comparing a speedboat to a massive cargo ship. Both are great at what they do, but they operate at totally different speeds for entirely different reasons. A speedboat needs to be nimble and fast. A cargo ship needs to prioritize stability and capacity for the long haul. Your ideal DIO is shaped by the same kinds of unique factors: what you sell, who you sell it to, and the natural rhythm of your market.

The single biggest factor shaping your target DIO is the nature of your products.

A business selling fresh meal kits has to aim for an incredibly low DIO—maybe just a few days—to keep things from spoiling. On the flip side, a merchant selling high-end, made-to-order furniture might have a DIO of over 150 days, and that could be a sign of a perfectly healthy business.

Chasing a generic "good" DIO of 30 days would be a disaster for that furniture store. It would force rushed production and kill quality. It would be just as catastrophic for the meal-kit company to let inventory sit for 30 days. This is exactly why you have to start with your industry's benchmarks to get a real sense of your own performance.

The goal isn't to hit some arbitrary number. It's to find the sweet spot for your business—that perfect balance where you have enough stock to meet demand without tying up a ton of cash in products that are just collecting dust.

To give you a clearer picture of how much this metric can swing, let's look at some typical DIO ranges for different ecommerce sectors.

The numbers vary wildly because the products and business models are so different. For example, fast-fashion retailers often shoot for a DIO between 30 to 40 days to keep their collections fresh and agile. In contrast, an auto parts distributor might be perfectly happy with a DIO around 60 to 90 days because of longer sales cycles and the sheer complexity of their inventory. And luxury goods? They often have even higher DIOs, sometimes pushing past 150 days, which makes sense given the exclusivity and slower turnover of their products. You can find more great insights on these industry-specific benchmarks at Finaleinventory.com.

This just goes to show why context is king. A 35-day DIO might be fantastic for a trendy apparel brand but a massive red flag for a vitamin store where customers expect their supplements to be in stock and ready to ship yesterday.

Since there's no universal standard, setting a meaningful goal for your DIO requires a more personal approach. Instead of looking outward for a magic number, you need to look inward at your own data and sideways at your direct competitors.

Here are the two best ways to benchmark your DIO:

Focusing on these two reference points helps you set realistic, strategic goals that actually fit your business. It also pushes you to dig deeper and figure out why certain products move faster than others.

For instance, using a technique like an ABC-XYZ analysis for your Shopify inventory can help you segment products by their value and sales velocity. This allows you to set different, more intelligent DIO targets for different product categories, moving you from just measuring DIO to actively managing it for better cash flow and profitability.

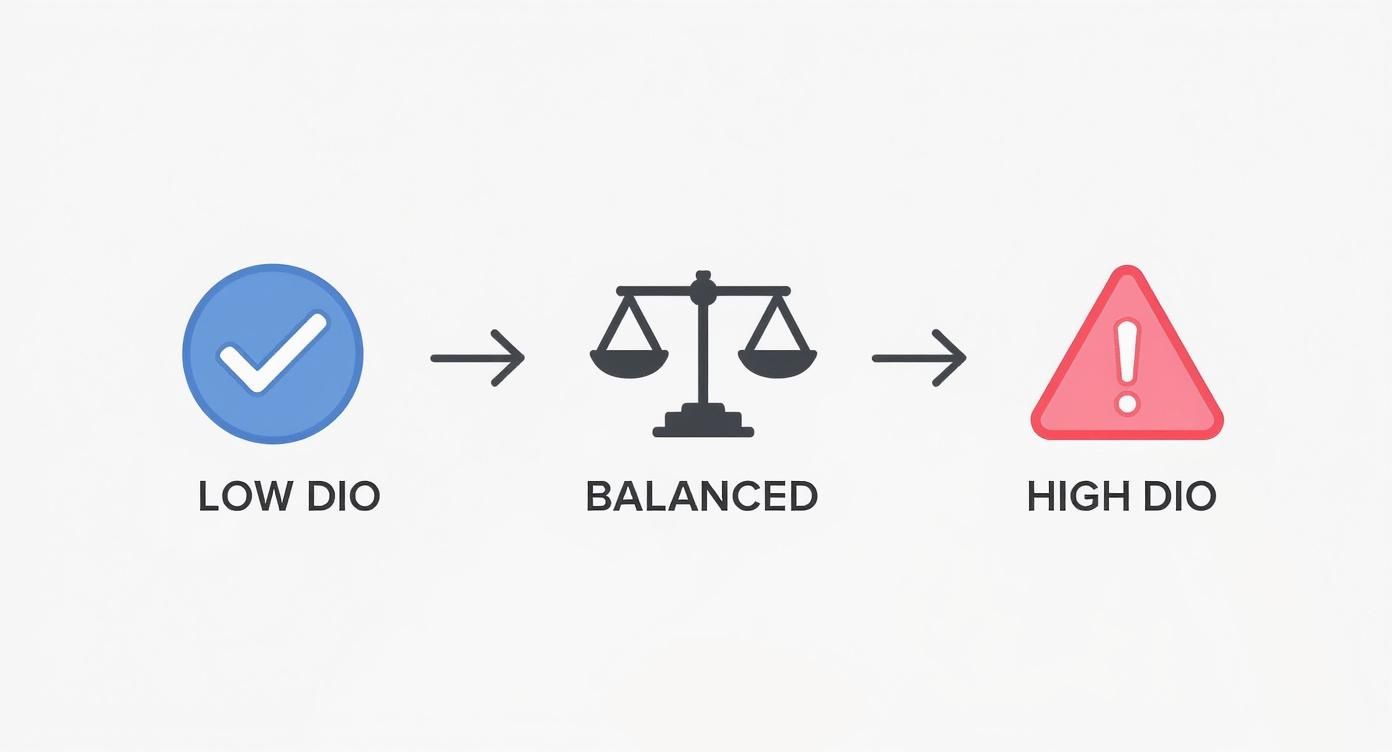

Your Days Inventory Outstanding isn't just another number on a spreadsheet; it's a health check for your business, and the results have real, tangible consequences for your bottom line. Think of it like a balancing act. If you lean too far in either direction—too high or too low—you're going to run into some costly problems.

A high DIO is the classic inventory headache. It’s a clear sign that your cash is literally collecting dust, tied up in unsold products sitting on warehouse shelves. Every single day those items go unsold, they're not just taking up space; they are actively draining your bank account through storage fees, insurance, and labor costs.

Worse yet, a high DIO dramatically increases the risk of inventory obsolescence. Products can expire, go out of style, or become outdated, forcing you to slash prices or, in the worst-case scenario, write them off as a complete loss. This slow-moving inventory becomes a financial anchor, holding back the capital you need to invest in new products, ramp up marketing, or jump on other growth opportunities.

On the flip side, an extremely low DIO can be just as damaging, though the reasons are different. It might look like you're running a hyper-efficient operation, but a DIO that’s too low is often a red flag for understocking. And understocking leads directly to the single most frustrating experience for a customer: the stockout.

When a customer lands on your site, ready to buy, only to be greeted by an "out of stock" message, you don't just lose that one sale. You risk losing their trust and all their future business. Persistent stockouts can wreck your brand's reputation, sending even your most loyal customers straight to your more reliable competitors. An overly lean inventory leaves you with no buffer for sudden demand spikes or supply chain hiccups, making your business fragile.

This is exactly why a smart safety stock calculation is non-negotiable. If you need a refresher, you can learn more about how to calculate safety stock in your inventory to build that essential cushion.

Understanding the trade-offs is key. A high DIO might mean you never run out of stock, but at what cost? A low DIO might look great for cash flow, but can you handle a sudden surge in orders? This table breaks down the good, the bad, and the ugly for both scenarios.

| Metric | High DIO (Slow Turnover) | Low DIO (Fast Turnover) |

|---|---|---|

| Cash Flow | 🔴 Cash is tied up in unsold inventory, restricting liquidity. | 🟢 Cash is freed up quickly for reinvestment. |

| Holding Costs | 🔴 High costs for storage, insurance, and labor. | 🟢 Lower carrying costs, saving money on warehousing. |

| Stockout Risk | 🟢 Low risk of stockouts; products are readily available. | 🔴 High risk of stockouts, leading to lost sales. |

| Obsolescence | 🔴 High risk of products becoming outdated or expiring. | 🟢 Low risk of obsolescence as inventory moves quickly. |

| Customer Experience | 🟢 Customers can always find what they want in stock. | 🔴 Frequent stockouts can frustrate customers and damage loyalty. |

| Operational Agility | 🔴 Slow to adapt to market changes or new product launches. | 🟢 Can pivot quickly to new trends and products. |

Ultimately, neither extreme is ideal. The goal is to land in that profitable sweet spot where you meet demand without drowning in holding costs.

So, where is that sweet spot? The truth is, it's not a single number but a dynamic range that requires constant attention. Even the retail giants are constantly tweaking their DIO to manage billions in cash flow.

Take Target, for example. In fiscal year 2021, they maintained an annual DIO of around 54.6 days. This was the result of a deliberate strategy to balance massive inventory levels with steady sales, ensuring shelves were stocked without tying up too much capital.

But that number isn't set in stone. During a Q3 inventory buildup that same year, their quarterly DIO jumped to 74.3 days as they prepared for the holiday rush. You can dig into the specifics of these kinds of calculations in a great inventory management article on netsuite.com.

This just goes to show that your "ideal" DIO isn't a static target. It needs to flex with seasonality, market trends, and your own business goals. Understanding the risks at both ends of the spectrum is the first step to finding—and maintaining—that profitable balance.

Knowing your Days Inventory Outstanding is the first step, but the real magic happens when you actively work to bring that number down. Lowering your DIO frees up cash, slashes holding costs, and makes your entire operation more agile. It’s about turning your inventory from a potential liability into your hardest-working asset.

The strategies below aren’t just theories; they’re practical, road-tested ways to get your products converting into revenue faster. You can start putting these ideas into practice today to build a leaner, more profitable business.

Think of it as a journey. You want to move from a high DIO, which signals risk, toward a low DIO that indicates healthy, efficient cash flow.

This visual really hammers it home: the goal is to shift your inventory out of the "warning" zone and into a balanced, low-DIO state. That's where you optimize capital and cut down on waste.

If there's one silver bullet for lowering your days inventory outstanding, it's this: stop guessing and start predicting. Solid demand forecasting is the bedrock of smart inventory management. It empowers you to order what you need, exactly when you need it.

Relying on gut feelings almost always leads to one of two bad outcomes: overstocking "just in case" or understocking and leaving money on the table. A data-driven approach takes that guesswork out of the equation. Start by digging into your historical sales data to spot trends, seasonality, and other patterns.

An AI-powered platform like Tociny.ai goes way beyond basic spreadsheets. It analyzes your sales history, market trends, and even external signals to generate incredibly precise sales forecasts. This gives you the confidence to order smarter, preventing the exact kind of excess inventory that bloats your DIO.

Imagine Tociny.ai predicts a demand spike for one of your product lines three months from now. That gives you the perfect window to place an optimal PO without tying up your cash too early. To dive deeper, check out our guide on different demand forecast methods and find the right fit for your brand.

Let's be real: not all of your products are created equal, so why manage them the same way? A one-size-fits-all replenishment strategy is a recipe for inefficiency. Taking a more nuanced approach, like using a Just-In-Time (JIT) model for certain items, can make a huge dent in your DIO.

JIT is all about receiving goods from suppliers only as you need them to fulfill orders. This keeps the amount of inventory you're physically holding to an absolute minimum.

While a full-blown JIT system requires rock-solid supplier relationships, you can definitely apply its core principles:

This strategy stops your capital from getting locked up in products that just sit on the shelf and ensures your most popular items are always flowing efficiently.

Every e-commerce brand has them—the products that just didn't take off like you'd hoped. Letting them collect dust is a direct drain on your business and a huge driver of a high days inventory outstanding. You have to manage this dead stock proactively.

First, you have to find it. An inventory analytics tool can be a lifesaver here, automatically flagging SKUs with low sales velocity. Tociny.ai, for example, surfaces these "at-risk" products right on your dashboard so you can't miss them.

Once you’ve identified the culprits, it’s time to take swift action and turn that dead stock back into cash:

By systematically identifying and clearing out stagnant inventory, you not only improve your DIO but also reclaim capital that can be reinvested into products your customers are actually excited to buy.

We’ve spent this whole guide pulling apart Days Inventory Outstanding, not just as some dry financial metric, but as a real lever you can pull to build a stronger, more profitable ecommerce business. Think of it as a stopwatch on your inventory. It tells you, down to the day, exactly how long your cash is frozen on a shelf. When you get a handle on this one number, managing your stock stops being a guessing game and becomes a genuine strategic advantage.

Along the way, we've laid out the essential steps. You now know how to calculate your DIO, and more importantly, what each part of that formula actually means for your store’s health. You also get that context is king—a “good” DIO isn’t some universal number, but a target you set based on your industry’s rhythm and your own past performance.

But the real magic happens when you turn these numbers into action. The strategies we walked through—from sharpening your demand forecasts to strategically clearing out slow-moving stock—are all designed to give you back control. Every single step you take to lower your days inventory outstanding puts cash back in your pocket, slashes your holding costs, and makes your entire operation more nimble.

When you make DIO a priority, you're literally unlocking capital that was trapped in your warehouse. That's cash you can use to make smarter, data-driven decisions that fuel real, sustainable growth for your brand.

So, the final message here is about empowerment. Start tracking your DIO today. Use it as a regular health check to understand your business’s natural cadence and pinpoint where you can get better. Stop letting your inventory be a passive cost center; it’s time to turn it into an active asset that works for you. By focusing on this critical metric, you're not just organizing your stock—you're building a much stronger financial foundation for whatever comes next.

Once you get the hang of the basic Days Inventory Outstanding formula, the real-world questions start popping up. Let's tackle some of the most common ones that ecommerce managers and store owners run into when they start putting DIO to work.

Here’s the short answer: more often than you think. Pulling your Days Inventory Outstanding once a year just gives you a blurry snapshot. It’s not nearly frequent enough to catch problems before they snowball.

For most D2C brands, a faster rhythm is the way to go:

The most important thing? Be consistent. Pick a schedule and stick to it. This builds a reliable history you can actually measure your performance against.

Believe it or not, yes—but it's incredibly rare and signals a very specific type of business model. A negative DIO happens when a company gets paid by its customers before it has to pay its suppliers for the goods.

Think dropshipping or made-to-order products. In these cases, you have virtually no upfront inventory costs because customer cash flow funds your purchases.

A negative Days Inventory Outstanding means you have a hyper-efficient cash conversion cycle. While it looks amazing on paper, this model depends entirely on perfect supply chain operations and rock-solid supplier relationships.

For any brand that holds its own physical stock, a negative DIO isn't a realistic (or even desirable) target. It’s more of a business model quirk than a universal benchmark for inventory health.

Your DIO is a critical piece of a bigger financial picture known as the Cash Conversion Cycle (CCC). The CCC measures the entire journey of your cash—from the moment you invest it in inventory to the moment you get it back from a customer sale.

The CCC formula is built on three key metrics:

DIO is the very first step in this cycle. Every single day you can shave off your DIO, you shorten your entire Cash Conversion Cycle. That means you get cash back into your business faster, freeing it up for growth, marketing, or anything else you need. This is what makes DIO such a powerful lever for boosting your store's financial health.

Ready to stop guessing and start making data-driven inventory decisions? Tociny.ai provides the clarity you need to optimize your stock levels, lower your DIO, and unlock profitable growth. Get early access and see what AI-powered inventory analytics can do for your Shopify store. Learn more at https://tociny.ai.

Tociny is in private beta — we’re onboarding a few select stores right now.

Book a short call to get early access and exclusive insights.