Think of Open to Buy (OTB) as the ultimate budget for your inventory. It’s a planning tool that tells you, in plain dollars, exactly how much new product you can afford to bring in each month. It helps you hit your sales targets without sinking all your cash into stuff that just sits on the shelf.

Let's break it down with a simple analogy: your personal bank account. You have money coming in (income) and money going out (expenses). To avoid trouble, you can't spend more than you make. An Open to Buy plan brings that exact same discipline to your retail business. It's a clear financial roadmap for your purchasing.

Without an OTB plan, buying inventory is mostly just a guessing game. You might get a good feeling about a product and order way too much, leading to overstock and profit-killing markdowns. Or, you play it too safe on a bestseller, run out of stock, and leave a pile of money on the table. OTB replaces that guesswork with a data-driven strategy, striking the perfect balance between what your customers want and what your business can actually afford.

At its heart, an OTB plan is all about making your inventory investment work smarter, not harder. It ensures that every dollar you spend on new stock is directly tied to your sales forecasts and financial goals. This structured approach helps you sidestep some of the most common—and expensive—mistakes in e-commerce.

For instance, a Shopify store without OTB might see a sudden sales spike for a particular SKU. The knee-jerk reaction? Place a massive reorder. But what happens when that demand cools off? They're left with a mountain of excess inventory that's not just taking up warehouse space; it’s tying up cash that could be fueling marketing campaigns or new product development.

An Open to Buy plan acts as a financial guardrail. It stops you from making reactive purchasing decisions and makes sure every dollar you spend on inventory has a clear, strategic purpose. It turns your stock from a potential liability into a powerhouse asset.

Putting an Open to Buy system in place gives you an immediate edge. It’s like getting a crystal-clear, forward-looking view of your purchasing power and inventory needs.

Here are the biggest wins:

Ultimately, an Open to Buy plan gives you the power to make smarter, more proactive decisions. It’s not some complicated tool reserved for big-box retailers; it's a foundational strategy for any Shopify merchant who wants to build a sustainable, profitable business. It helps you control your inventory, so it doesn't end up controlling you.

Alright, now that we've covered the "why" behind an Open to Buy plan, let's roll up our sleeves and get into the "how." The math itself isn't rocket science, but each piece of the formula tells a crucial part of your brand's financial story. Think of it like putting together a puzzle—once all the pieces click into place, you get a crystal-clear picture of your real purchasing power.

At its heart, the OTB formula is a simple way to figure out how much new inventory you can actually afford to buy for a specific period, usually a month. It works by balancing what you plan to sell against the stock you already have. This keeps you from buying too little and missing sales, or worse, buying too much and tying up all your cash in products that just sit there.

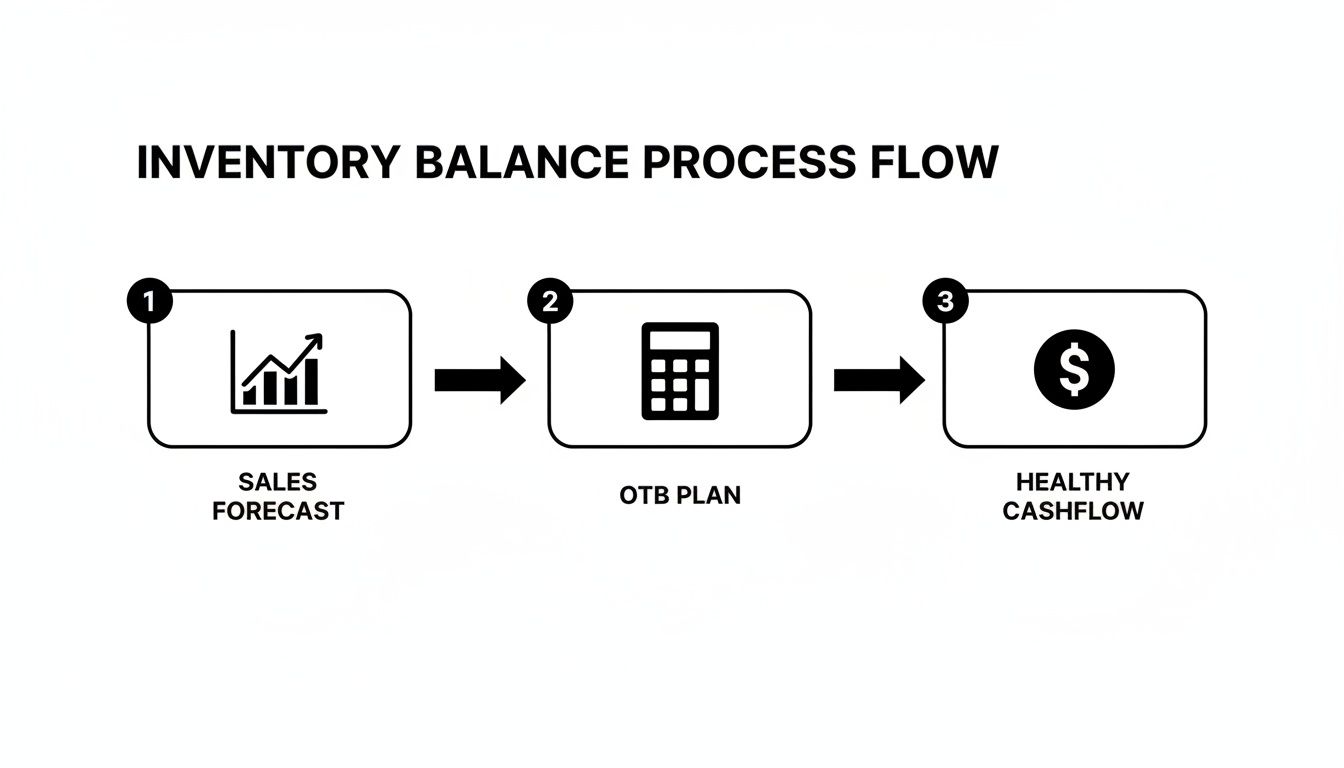

This is the classic flow: a solid sales forecast leads to a smart OTB plan, which in turn keeps your cash flow healthy.

See how each step flows into the next? This is how you shift your inventory planning from reactive guesswork to a proactive financial strategy.

So, what's the magic formula? It’s all about bringing your goals and your current reality together.

Here’s the standard Open to Buy formula:

OTB = Planned Sales + Planned Markdowns + Planned End-of-Month (EOM) Inventory – Beginning-of-Month (BOM) Inventory

Let's quickly break down what each of those moving parts actually means for your store.

This table unpacks each component of the formula, explaining what it represents and why it's so important for your planning.

| Component | Description | Why It Matters |

|---|---|---|

| Planned Sales | Your best guess at how much you'll sell in the upcoming period (e.g., a month), measured in dollars. | This is the engine of your OTB. If it's wrong, everything else will be off. A good forecast prevents stockouts or overstocks. |

| Planned Markdowns | The total value of discounts, promotions, or clearance sales you plan to run during the period. | Forgetting to account for markdowns means you'll underestimate how much inventory you're actually moving, leading to over-buying. |

| Planned EOM Inventory | The dollar value of inventory you want to have on hand at the end of the period. | This is your safety stock for the next month. It ensures you have enough product to start the following period strong without waiting for new shipments. |

| BOM Inventory | The actual dollar value of the inventory you have in stock at the beginning of the period. | This is your starting point—your reality. It's not a plan or a forecast; it’s what you physically have on your shelves right now. |

Understanding these four pieces is the key to creating a budget that truly works for your business.

Your Planned Sales number is the most critical input. Getting this right sets the foundation for the entire calculation. If you want to sharpen your projections, check out our guide on different demand forecast methods.

Let's put this into practice. Imagine you run a trendy D2C accessories store on Shopify called "Golden Hour." It’s late September, and you’re mapping out your inventory budget for October.

Here’s the data you’ve pulled together:

Now, let's plug these numbers into the formula:

OTB = $20,000 (Sales) + $500 (Markdowns) + $30,000 (EOM) – $28,000 (BOM)

OTB = $22,500

And there you have it. That $22,500 is your open to buy budget. It’s not just a random number you pulled out of thin air; it’s a strategic purchasing budget telling you exactly how much you can spend on new products in October to hit your goals.

This structured approach gives retailers a safe spending limit. For instance, if another retailer forecasted $15,000 in sales, needed $25,000 in ending inventory, and already had $30,000 on hand, their OTB would be just $10,350 after accounting for markdowns. The formula adapts to your specific situation every single time.

An Open to Buy plan is so much more than just a fancy budget number. It fundamentally changes how you think about and manage the financial core of your store. Once you get past the formulas, a solid OTB framework gives you some serious strategic firepower, turning your inventory from a potential liability into your biggest asset.

The most immediate win? A massive improvement in your cash flow. For most D2C brands, inventory is the single biggest check you write. Without an OTB plan, it's dangerously easy to sink all your cash into products that just sit there, tying up money you desperately need for marketing, new product development, or just keeping the lights on.

Think of an OTB plan as a financial guardrail. It forces every single purchase order to align with what you actually expect to sell, stopping you from dumping thousands into products that will do nothing but collect dust in a warehouse. This discipline keeps your money working for you, not trapped on a shelf.

What's one of the fastest ways to kill your profits? The dreaded markdown cycle. When you overbuy, you're eventually forced to slash prices just to free up cash and space. This doesn't just crush your margins; it cheapens your brand in the eyes of your customers.

An OTB plan is your best defense against this downward spiral.

By buying only what you have a data-backed reason to believe you can sell, you drastically cut the odds of being stuck with a mountain of excess stock at the end of the season. It’s a proactive strategy that minimizes the need for those deep, profit-killing discounts.

An OTB plan flips your inventory strategy from reactive to proactive. You stop asking, "How do we get rid of all this extra stock?" and start asking, "How can we strategically invest in what our customers are actually buying?"

This shift has a huge ripple effect on your bottom line. You’re not just protecting your margins from markdowns; you're also freeing up capital to double down on your bestsellers or test out new products with real potential.

E-commerce moves at the speed of social media. A new trend can blow up overnight, and if you can't react quickly, you're already behind. An OTB plan gives you the financial agility to ride these waves instead of getting wiped out by them.

Let's paint a quick before-and-after picture:

This data-driven approach takes the emotion and guesswork out of buying. You always have a clear view of your financial capacity, which empowers you to make quick, strategic moves. You can jump on a hot trend, restock a bestseller before it sells out, and handle seasonal spikes without gambling with your cash.

Ultimately, an OTB plan is about taking back control. It provides the clarity and foresight you need to build a more resilient and profitable business. You stop letting your inventory run your finances and start using your finances to build a smarter inventory.

An effective Open to Buy plan isn't something you create once and file away. Think of it less like a rigid blueprint and more like a living, breathing financial guide for your inventory. It has to be.

The market doesn't stand still—trends pop up overnight, competitors launch surprise sales, and customer demand can pivot on a dime. A static plan is a missed opportunity at best and a financial liability at worst. To truly get the most out of your open to buy strategy, you have to treat it as a dynamic tool that adapts to the real world. This agility is what separates the brands that just survive from the ones that truly thrive.

Your OTB plan is only as good as the numbers you feed it, especially your planned sales figures. A basic forecast might just look at what you did last year, but a truly adaptive plan goes deeper, pulling in current trends and what you know is coming next.

Consider a few real-world scenarios where your starting forecast needs a reality check:

The goal is to create a feedback loop where real-time market intelligence constantly informs and refines your purchasing plan. This proactive stance allows you to capitalize on opportunities before they pass you by.

So, how do you keep your OTB plan in sync with such a fast-moving market? The secret is building a consistent and disciplined review cadence. The single biggest mistake a merchant can make is creating a plan and then sticking it in a drawer.

Your review cycle should match the pace of your business. For most D2C brands, that looks something like this:

Things you can't predict—like economic shifts or even a sudden cold snap—can hit your sales hard. This is where a responsive OTB plan really shines. It gives you the framework to pivot your buying strategy on the fly, like quickly reordering sweaters instead of sandals. This kind of demand-responsive adjustment makes sure your budget is spent on items that will actually move.

This level of flexibility also highlights why having a well-managed inventory buffer is so critical. To get a better handle on protecting your store from surprise demand, check out our guide on how to calculate safety stock in inventory. Think of it as your first line of defense while you adjust your OTB plan.

Ultimately, adapting your OTB plan isn't just about tweaking numbers on a spreadsheet. It’s about building a resilient and opportunistic inventory strategy that bends with the market instead of breaking under pressure. Regular reviews transform your OTB from a simple budget into a powerful strategic tool that fuels growth and protects your bottom line.

Rolling out your first open to buy plan feels like a massive win. But like any powerful tool, it’s only as good as the person using it. I’ve seen countless merchants get tripped up by a few common—and entirely preventable—mistakes that can sink their entire inventory strategy.

Getting a handle on these pitfalls is the difference between an OTB plan that’s just a spreadsheet and one that actually drives profit.

One of the quickest ways to derail your OTB plan is to build it on overly optimistic sales forecasts. It’s tempting to project massive growth—we all want our brands to succeed. But a forecast rooted in ambition instead of actual data is a recipe for disaster.

This one misstep directly inflates your OTB budget, giving you the green light to buy way more inventory than you can realistically sell. You know what happens next: cash flow gets tight, shelves are packed with dead stock, and you’re forced into profit-killing markdowns just to clear it all out.

Another classic mistake is treating your OTB plan like a static document. Some merchants will grind away to create the perfect plan at the start of the quarter, only to file it away and never look at it again. This completely misses the whole point.

The world of e-commerce moves fast. Customer demand can shift in a week, let alone a quarter. A "set it and forget it" approach leaves you flying blind.

Think of your Open to Buy plan not as a photograph, but as a live video stream of your business's health. It needs to be monitored and adjusted constantly to have any real strategic value.

When you aren't regularly updating your plan, you're not reacting to what's actually happening. A product might be taking off, but your outdated plan won't signal that you need to free up the budget to restock it. At the same time, a poor seller will just keep chewing up capital because you haven't adjusted its forecast down.

This next one is a classic rookie error. Many planners craft their OTB budgets without accounting for all the inventory that vanishes without a sale. I’m talking about shrinkage, returns, and damages—the silent killers that reduce your on-hand stock just as much as a customer purchase.

Forgetting to factor these in gives you a dangerously inaccurate picture of what you actually need to buy. Here’s a quick rundown of what gets missed:

If you don't build these realities into your plan, you’ll constantly under-budget for new purchases. You'll think you have more stock than you do, leading to surprise stockouts on hot items and, ultimately, lost sales. The fix is to dig into your historical data for these metrics and build a realistic buffer into your OTB calculation.

Look, a spreadsheet is a fine place to start with your open to buy plan. But let's be honest—the speed of modern ecommerce can make a manual spreadsheet feel like you're trying to win a race on a tricycle.

Manually pulling sales data, updating your forecasts, and rejiggering your budget every single week isn't just a time suck. It’s a minefield of potential human errors. One bad copy-paste and your entire purchasing strategy is thrown off course for the month.

This is where you graduate from basic inventory management to something much smarter: AI-powered automation. Instead of getting buried in rows and columns, you can let specialized platforms do the heavy lifting. This frees you up to think about strategy, not data entry.

Imagine an OTB system that's always on and always current. That’s the real magic of automation. Platforms like Tociny.ai are built to plug directly into your Shopify store, creating a seamless flow of information that makes all that manual work a thing of the past.

This completely changes the game for your OTB planning in a few critical ways:

This constant feedback loop turns your OTB plan from a static document into a living, breathing guide that helps you make faster, more confident buying decisions.

Bringing in an automated solution does more than just save you a few hours each week; it gives you a serious strategic advantage. Smart OTB planning is the bridge between your high-level financial goals and the day-to-day grind of managing inventory. It’s no surprise that companies who nail their OTB consistently see better inventory turnover, which is directly tied to higher profits and fewer soul-crushing markdowns.

By automating the tedious parts of OTB planning, you shift your focus from calculating the numbers to interpreting them. The system handles the "what," so you can concentrate on the "why" and "what's next."

This leads to real, tangible results. You can spot slow-moving products sooner, shift your budget to bestsellers before they stock out, and confidently invest in new products knowing your decisions are backed by solid, data-driven predictions. Automation closes the gap between OTB theory and a practical, powerful inventory strategy that any ambitious brand can use.

As you start wrapping your head around open to buy, a few questions inevitably pop up. It's one thing to understand the theory, but applying it to your own Shopify store is where the real learning begins. Let's walk through some of the most common questions we hear from merchants.

There's no single right answer here—it all comes down to the sales velocity in your niche. Trying to use a one-size-fits-all approach is a recipe for frustration.

Absolutely. While an OTB plan gets more precise with historical sales data, a new business can—and should—use one by building a solid, well-researched forecast.

Instead of your own past sales, you'll lean on other data points to create your initial planned sales numbers.

Don't let a lack of history hold you back. An OTB plan is an incredible tool for instilling financial discipline from day one, helping you dodge the expensive overstocking mistakes that trip up so many new stores.

Start with market research for your category, take a hard look at competitor sales patterns, and set achievable goals based on your marketing spend and early traffic projections. Your first few OTB plans will be educated guesses, but they provide the essential guardrails for your first inventory buys.

This is a fantastic question, and the distinction is crucial for your financial planning. You can calculate your open to buy budget using either the retail price of your products or what they cost you.

Most merchants start by planning their OTB at retail to align with sales targets, then convert it to cost when it’s time to write the actual purchase orders. To do that, you just multiply your OTB at retail by your initial markup percentage. For instance, if your OTB at retail is $10,000 and your products have a 60% gross margin, your OTB at cost is $4,000.

Ready to graduate from spreadsheets and automate your inventory planning? Tociny.ai uses AI to create razor-sharp sales forecasts and dynamic OTB plans, helping you make smarter buying decisions in a fraction of the time. Join the private beta and see what AI-powered inventory management can do for your Shopify store.

Tociny is in private beta — we’re onboarding a few select stores right now.

Book a short call to get early access and exclusive insights.