At its core, demand planning is all about looking ahead to figure out what your customers will want, and then making sure you can actually give it to them. Think of it less as a wild sales guess and more as a strategic blueprint that connects your inventory, production, and marketing, so you can dodge stockouts and avoid drowning in excess stock.

Imagine you're the captain of a ship about to set off on a long voyage. You wouldn't just point the bow in a general direction and hope you hit your destination. You'd meticulously plot a course using sea charts (your historical sales data), weather reports (current market trends), and a deep understanding of your ship's capabilities (your supply chain capacity).

That's exactly what demand planning does for your business. It’s your strategic GPS, helping you navigate the unpredictable waters of commerce. It steers you clear of the costly storm of stockouts and helps you conserve fuel by not carrying the dead weight of overstocked inventory.

People often mix up demand planning with forecasting, but a sales forecast is just one piece of the puzzle. Forecasting predicts what customers might buy. Demand planning takes that prediction and builds a full-blown operational plan around it.

It's a company-wide huddle that gets everyone—from marketing and finance to the folks ordering raw materials—on the same page. This sync-up ensures you’re always ready to deliver what your customers need, right when they need it. The real goal is to strike that perfect balance between keeping customers happy and keeping your operational costs in check.

Demand planning bridges the gap between what sales hopes to sell and what operations can realistically deliver. By getting everyone to agree on one forecast, you eliminate internal friction and those frantic, expensive last-minute adjustments.

Many merchants find themselves stuck in a tangled web of conflicting goals. Sales wants to sell everything, finance wants to spend nothing, and operations is caught in the middle. To help clarify how these functions should work together, let's break down the key differences.

This table clarifies the distinct roles these three critical functions play in your supply chain, helping you understand how they work together.

| Concept | Primary Goal | Key Question It Answers | Analogy |

|---|---|---|---|

| Forecasting | Predict future sales volume | "How much of Product X will we likely sell next quarter?" | The weather report. It gives you a probability, but it isn't the journey itself. |

| Demand Planning | Create a consensus-based operational plan to meet the forecast | "What do we need to do to meet that predicted demand?" | The voyage plan. It uses the weather report to map the route, crew schedule, and required supplies. |

| Inventory Control | Manage the stock on hand to execute the plan | "How much of Product X should we order right now to stay on plan?" | The ship's rudder. It makes real-time adjustments to keep the ship on the planned course. |

Simply put, forecasting is the prediction, demand planning is the strategy, and inventory control is the execution. Each one is essential, but they are not the same thing.

Getting demand planning right isn't just a "nice-to-have"; it's a core part of building a resilient and profitable business. Its growing importance is why the global market for demand planning solutions was valued at around USD 4.49 billion in 2025. Experts project it to grow at a compound annual growth rate (CAGR) of about 11.7%, hitting nearly USD 9.82 billion by 2032, according to recent market analysis.

This is exactly why so many D2C brands are finally ditching reactive, gut-feel ordering for a more structured planning process. The benefits hit your bottom line directly:

Good demand planning isn’t a one-and-done task. It’s a cycle, a structured process that repeats over and over. Think of it like a four-part harmony; each part is distinct, but they all have to work together to create a cohesive result. For D2C brands, getting this cycle right is the difference between chaotic, reactive ordering and a proactive strategy that aligns your entire operation.

The whole process usually unfolds in four key stages, typically on a monthly basis.

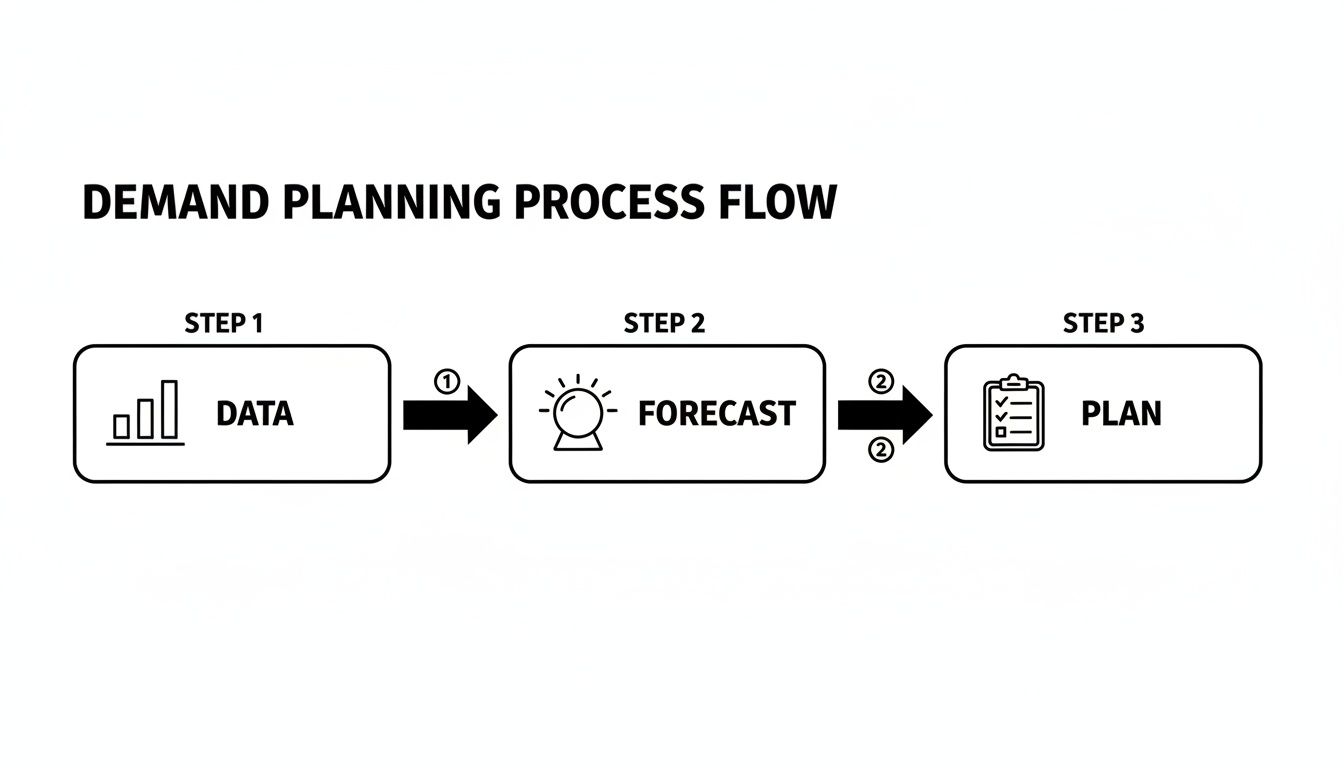

This flow shows how you turn raw data into a forecast, and then into a concrete plan you can actually execute on. It’s all about moving from information to strategic decisions.

First things first, you need to collect the raw ingredients for your forecast. Your plan will only be as good as the data you feed into it, making this foundational step absolutely critical. The goal here is to build a clean, reliable dataset that gives you a true picture of your business history.

You’ll be pulling information from all over the place. This includes historical sales data from your Shopify store, marketing calendars that detail upcoming promotions, and maybe even external factors like competitor sales or seasonal trends.

It's just as important to "cleanse" this data by removing outliers—like that one-off bulk order from a corporate client—that could throw off your future predictions.

With clean data ready to go, you can now generate a statistical forecast. This is your baseline prediction, an objective, data-driven look at what future demand might look like. It’s the mathematical starting point for your entire plan.

This forecast uses historical trends and seasonality to project what’s coming. For example, it’ll recognize that your sunscreen sales spike every summer or that your best-selling candle sees a predictable drop after the holidays. Modern tools can automate this, creating a solid baseline without you having to crunch numbers in a spreadsheet for hours. This initial forecast serves as the unbiased foundation you'll build upon with human intelligence.

A statistical forecast gives you the "what"—the unvarnished, data-backed prediction. The next stage, collaborative enrichment, provides the "why"—the crucial context that data alone can't see.

This is where the real magic happens. A statistical forecast is powerful, but it doesn’t know about the huge influencer campaign your marketing team is about to launch. This collaborative stage is where you layer that vital human insight onto the baseline numbers.

Your sales, marketing, and product teams need to huddle up, review the initial forecast, and add their expert input. This process, often part of a formal Sales and Operations Planning (S&OP) meeting, is all about asking the right questions:

This qualitative feedback adjusts the baseline forecast, making it a much closer reflection of reality. For instance, if the statistical forecast for a specific SKU is 500 units but marketing is planning a major push, the team might agree to adjust that forecast up to 800 units.

The final stage is all about getting everyone on the same page and creating a plan you can act on. After incorporating all the collaborative input, the teams lock in the consensus demand plan. This becomes the single source of truth that the entire company will operate from for the next month or quarter.

This isn't just a number on a spreadsheet; it's a commitment. This final plan gets handed over to the supply chain and finance teams, who use it to make critical decisions. They translate the demand plan into a concrete action plan, figuring out exactly what to order, when to produce it, and how to allocate inventory.

This final step ensures everyone—from the marketing team buying ads to the warehouse team receiving stock—is working from the same script. That's how you drive real efficiency and profitability.

You can't improve what you don't measure. A solid demand planning process feels good, but without clear metrics, you're just flying blind.

Tracking the right Key Performance Indicators (KPIs) is the only real way to know if your efforts are paying off and to find exactly where you can get better. This isn’t about generating a bunch of dusty reports; it’s about turning raw data into profitable decisions for your D2C brand.

Think of these metrics as a health check for your entire supply chain. They tell you how accurate your predictions are, how efficiently you’re using your capital, and, most importantly, how well you're keeping your customers happy.

Let's break down the essential KPIs every D2C merchant should have on their dashboard.

This is the big one—the cornerstone of demand planning. Forecast Accuracy simply measures how close your predictions were to what customers actually bought.

A high accuracy rate means you have a reliable, well-oiled planning process. A low rate, on the other hand, is a sure sign you’re stuck in a frustrating cycle of stockouts and overstocks.

One of the most common ways to track this is with the Mean Absolute Percentage Error (MAPE). The name sounds a bit academic, but the concept is straightforward: it calculates the average percentage difference between your forecast and your actual sales.

Nailing this metric is fundamental to the entire process. For a deeper look into this crucial KPI, check out our detailed guide on how to calculate and improve demand forecasting accuracy. Consistently tracking MAPE helps you see if your collaborative inputs and adjustments are actually making your forecasts better over time.

Cash flow is king in ecommerce, and Inventory Turnover shows you how hard your cash is working. This metric tells you how many times you sell through your entire inventory over a specific period.

A high turnover is almost always a great sign. It means products are flying off the virtual shelves and you aren't tying up precious capital in slow-moving stock. A low turnover, however, can be a major red flag, pointing to weak sales or bloated inventory levels that are costing you a fortune in storage fees.

If your turnover is sluggish, it’s a clear signal to review the demand plan for those specific SKUs. You might need to run a flash sale to clear out old stock or adjust your future purchase orders to better match the real rate of sale.

Your inventory isn't just a collection of products; it's a stack of cash in physical form. A high turnover rate means you are quickly converting that cash back into revenue, fueling your business growth.

Few things will kill a sale faster than that dreaded "out of stock" message. The Stockout Rate puts a number to these missed opportunities. It measures the percentage of orders you couldn't fulfill simply because you didn't have the product on hand.

This metric directly hits both your revenue and your brand's reputation. A high stockout rate means lost sales today and can poison customer loyalty for good, sending shoppers straight to your competitors.

Monitoring these core metrics isn't just about tracking numbers—it's about creating a powerful feedback loop. Here's a quick reference table to keep these KPIs top of mind.

This table breaks down the most important metrics, how to calculate them, and what they really mean for your business's health.

| Metric | Formula | What It Measures | Actionable Goal |

|---|---|---|---|

| Forecast Accuracy | (Sum of |Actual - Forecast| / Sum of Actual) * 100 | The reliability and precision of your predictions. | Get MAPE below 30%; aim for under 20% on key SKUs. |

| Inventory Turnover | Cost of Goods Sold / Average Inventory Value | The efficiency of your inventory investment. | Aim for a ratio between 4 and 6. |

| Stockout Rate | (Number of Items Out of Stock / Total Items Offered) * 100 | Lost sales and customer dissatisfaction. | Keep it below 5% to protect revenue and loyalty. |

By consistently tracking Forecast Accuracy, Inventory Turnover, and Stockout Rate, you can move beyond guesswork. This data-driven approach allows you to systematically fine-tune your demand planning process, building a more resilient and profitable brand in the process.

Even the sharpest brands stumble into common demand planning traps. These aren't just small slip-ups; they're the kind of mistakes that tie up capital in the wrong products, lead to frustrating stockouts, and create endless operational headaches. The first step to building a more resilient, profitable business is spotting these pitfalls before they do real damage.

The good news? Every one of these mistakes is entirely fixable. By understanding where D2C brands usually go wrong, you can sidestep these issues and avoid learning the hard way. Let’s break down the most frequent errors and, more importantly, what to do about them.

One of the biggest blunders is assuming the future will look just like the past. Sticking only to historical sales data for your forecast is like driving a car while looking exclusively in the rearview mirror. Sure, it tells you where you’ve been, but it won’t warn you about the sharp turn right in front of you.

Imagine you sell a popular line of jackets. Last year's data shows a nice, steady sales pattern. But that data has no idea that a major fashion influencer is about to feature your signature piece in a viral video, or that an unseasonably warm winter is on the horizon. A forecast based only on history would miss these game-changing events, leaving you either scrambling to fulfill orders or stuck with a mountain of unsold coats.

The Fix: You need to enrich your historical numbers with real-world, qualitative insights. A solid forecast is a blend of quantitative data and the human intelligence sitting within your marketing, sales, and product teams.

When your marketing, operations, and finance teams are all working from different playbooks, you're setting yourself up for chaos. Marketing might be planning a massive flash sale, but if they don’t tell the inventory team, you won't have nearly enough stock to cover the surge. The result? A wildly successful promotion that turns into a stockout disaster, complete with angry customers and lost revenue.

This lack of communication creates friction and kills efficiency. Each team ends up optimizing for their own goals—marketing wants traffic, finance wants to cut costs—often at the expense of the business as a whole.

The Fix: You need a single source of truth. The best way to achieve this is with a collaborative Sales and Operations Planning (S&OP) process. This is basically a recurring meeting where leaders from each department come together to agree on one unified demand plan. This consensus plan becomes the one number everyone in the company works toward.

A successful S&OP process isn't just another meeting; it's a cultural shift. It forces teams to break down silos and align their individual goals with the company's overarching strategy, ensuring everyone is rowing in the same direction.

Spreadsheets are a fantastic tool when you're just starting out. But as your business grows, they quickly become a liability. They're notoriously fragile—one broken formula or an accidental deletion can throw your entire forecast into question. Version control turns into a nightmare, with different people working from outdated files named Forecast_FINAL_v2_updated.xlsx.

Beyond that, spreadsheets just can't handle the complexity of a modern D2C brand with dozens of SKUs, multiple sales channels, and a packed promotional calendar. As your data grows, they become slow, clunky, and a genuine obstacle to making quick, smart decisions. They put a hard cap on your ability to scale.

The Fix: The moment you start feeling the spreadsheet pain, it's time to invest in a dedicated demand planning tool. Modern platforms automate all the tedious data gathering, run more accurate statistical models, and give your team a central hub to collaborate. Tools like Tociny.ai are built to replace spreadsheet chaos with clarity, giving you a reliable foundation for your planning without all the manual effort and risk. It's a critical step for any brand that's serious about growing efficiently.

Overflowing spreadsheets and manual planning can only take a growing brand so far. To get to the next level, you have to move from reactive adjustments to proactive strategy, and Artificial Intelligence (AI) is the engine that powers this shift. It turns demand planning from a tedious chore into a serious competitive advantage.

Traditional forecasting relies heavily on historical sales averages. That's like trying to drive a winding road by only looking in the rearview mirror. AI, on the other hand, acts more like a sophisticated GPS, analyzing countless real-time data points to anticipate what's coming around the next turn.

This is a great visual for how AI connects raw data with intelligent processing, turning complex information into clear, actionable forecasts for your business.

AI-driven platforms like Tociny.ai don’t just look at what you sold last year. They analyze complex layers of information that are simply impossible for a human to track manually.

These systems can spot subtle patterns and correlations in your data, answering critical questions like:

By processing all these variables, AI generates highly accurate forecasts right down to the individual SKU level. It automates the tedious data work, freeing up your team to focus on strategy instead of getting buried in numbers. If you want to go deeper on the different approaches, you can explore the various demand forecast methods that modern tools use.

The real magic of AI in demand planning is its ability to find the "why" behind the numbers. Instead of just seeing a sales spike, an AI model can connect it to a recent influencer mention or a competitor's price change. This lets you finally understand the actual drivers of demand.

This capability is quickly becoming a must-have. A 2025 survey of over 300 executives in consumer lifestyle and apparel revealed that 91% of companies see AI insights as critical to their growth. The same report found that 77% consider demand planning tools a top priority for 2025, which tells you everything you need to know about the need for smarter tools to handle supply chain headaches and shifting markets. You can learn more about these demand planning priority findings in the full report.

AI doesn't replace human expertise; it supercharges it. By handling the complex data analysis, it empowers your team to make faster, more informed decisions with a level of confidence that spreadsheets can never provide.

One of the most valuable features of modern AI planning tools is the ability to run "what-if" scenarios. This lets you game out the potential impact of future business decisions before you commit a single dollar.

For example, you could model questions like:

This simulation capability turns your demand plan into a dynamic, strategic tool. It gives D2C brands a level of planning precision that was once only available to massive enterprises with huge budgets. By making AI accessible, platforms like Tociny.ai level the playing field, helping smaller brands plan smarter, cut waste, and build more resilient businesses.

Theory is one thing, but actually putting it into practice is a whole different ball game. Turning the idea of demand planning into a real-world, profit-driving machine for your D2C brand takes a focused, hands-on approach. This is your roadmap for getting it done—a set of best practices to help you move from chaotic spreadsheets to a clear, actionable strategy.

Don't feel like you have to build a super-sophisticated system overnight. The real key is to start simple, build some momentum, and focus on the actions that will give you the biggest bang for your buck right away. Think of it like building a house: you pour a strong foundation before you start worrying about the complex details.

Stop trying to boil the ocean by creating a perfect forecast for every single SKU you sell. That's a recipe for burnout. Instead, start with the 80/20 rule. Focus your energy on the small group of products—probably around 20% of your catalog—that drive 80% of your revenue.

These are your "A" items, the products where getting the forecast wrong really hurts your bottom line. By nailing the demand plan for these top-sellers first, you solve your most expensive problems and build confidence in the new process. Once you’ve got a good handle on those, you can start expanding your focus to the rest of your product line.

Good demand planning is a team sport, not something one person does in a silo. The best way to get everyone on the same page is by setting up a simple but consistent Sales and Operations Planning (S&OP) meeting rhythm. This doesn't need to be some all-day corporate affair; for most D2C brands, a focused monthly meeting is the perfect place to start.

The goal for this meeting is pretty straightforward:

This regular meeting breaks down the walls between departments and makes sure your inventory decisions are always in sync with your marketing and sales plans.

A consistent S&OP meeting transforms demand planning from a disconnected task into a core business process. It creates a single source of truth that aligns the entire company around one unified goal, eliminating costly miscommunications.

You can’t build a reliable plan on a shaky foundation of messy, conflicting data. One of the most important things you can do is ditch the scattered spreadsheets and establish a single source of truth for all your planning data. This means pulling information from Shopify, your marketing platforms, and your inventory systems into one clean, accessible place.

Globally, companies that get this right are seeing massive wins. Using AI-driven demand planning tools has helped leading brands cut inventory costs by 20% to 30% and boost forecast accuracy by up to 65%. These aren't just pie-in-the-sky numbers; they come from replacing error-prone manual work with smart platforms that use real-time data to create a unified view.

Putting these practices into action doesn't just improve your forecasts—it makes your entire operation more resilient and profitable. They are the foundational steps that lead to smarter growth, better cash flow, and a much more stable business. These principles are also tightly linked to great inventory management. For a deeper dive, check out our guide on the best practices for inventory management.

As you start wrapping your head around demand planning, a few practical questions always pop up. Let's tackle the most common ones we hear from D2C merchants to help you get moving.

For most brands, running a full, top-to-bottom review of your demand plan on a monthly cycle is the sweet spot. This gives you enough time to collect meaningful data without letting you fall too far behind market shifts.

That said, you should absolutely be keeping an eye on your sales data weekly. This is your early warning system. If you see a big deviation from what you planned, you can react quickly instead of waiting until the end of the month. For products that move lightning-fast or have crazy seasonal spikes, you might even adopt a "rolling forecast" that gets tweaked more often.

This is easily the biggest point of confusion, but there's a simple way to think about it. A sales forecast is just one ingredient in the much larger recipe of demand planning.

Of course. And you should! Using a spreadsheet is infinitely better than having no plan at all. It's a fantastic way to get your hands dirty and really learn the fundamentals of the process. Countless successful brands got their start organizing their first forecasts in Excel.

Just go in with your eyes open about the limitations. Spreadsheets are notorious for human error (one bad formula can wreck everything), they become a tangled mess as your product catalog grows, and getting genuine team collaboration is tough. Once you start to feel that pain, it’s a sign that you’re ready to graduate. Investing in a proper tool will save you a ton of time, boost your accuracy, and cut down the risk of making a very expensive mistake.

Ready to move beyond spreadsheets and build a more resilient supply chain? Tociny.ai uses AI to provide clear, actionable inventory insights and generate precise demand forecasts for your Shopify store. Start planning with confidence today.

Tociny is in private beta — we’re onboarding a few select stores right now.

Book a short call to get early access and exclusive insights.