A forecast accuracy formula is a mathematical equation used to measure the difference between a predicted outcome (the forecast) and the actual result.

Ever planned a big backyard party? If you guess way too high on the guest count, you're stuck with mountains of expensive, wasted food. Underestimate, and you run out of drinks an hour in, leaving everyone disappointed.

Running a Shopify store is a lot like that, but the stakes are higher. This is where forecast accuracy becomes your most critical planning tool.

In plain English, forecast accuracy measures how close your sales predictions are to what actually happens. It’s the metric that tells you if your business's "party planning" is on point or if you're setting yourself up for some costly mistakes. For any D2C brand, getting this right is non-negotiable.

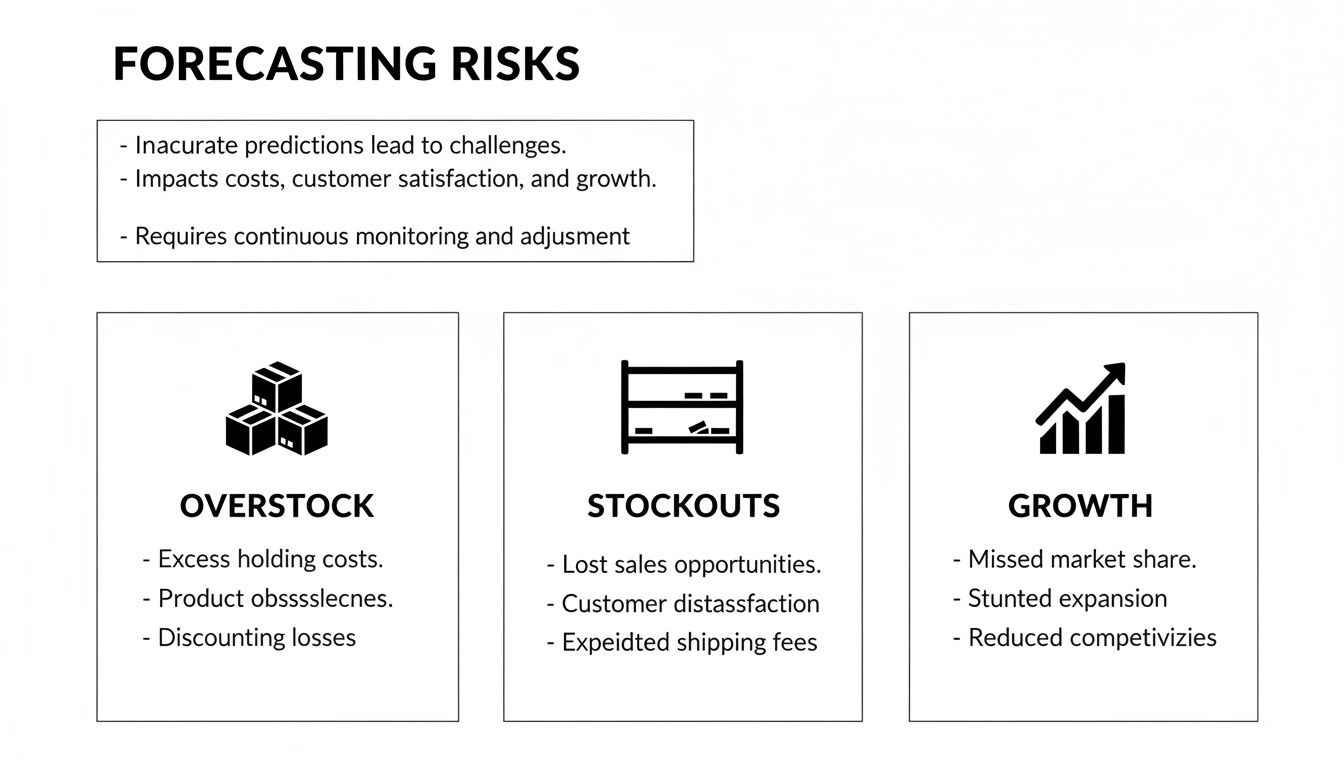

Bad forecasting isn't just a minor headache; it's a direct assault on your bottom line from two different directions.

When you consistently overestimate demand, your cash gets trapped in overstocked products collecting dust on a warehouse shelf. This "dead stock" isn't just a lost investment—it racks up storage costs, slowly eating away at your profits. Some industry estimates suggest excess inventory can slash a company's profitability by 20% to 30% a year.

On the flip side, underestimating demand leads to stockouts, which is arguably even more damaging. A stockout means a lost sale today and, very possibly, a lost customer for good. When a shopper lands on your site ready to buy, only to be met with an "out of stock" notice, they're not waiting around. They're heading straight to your competitor.

"Forecast accuracy is a method you can use to judge the quality of your forecasts. In the context of supply chain planning, forecast accuracy refers to how closely the predicted demand for products or services matches the actual demand."

Getting a handle on this pays huge dividends. Accurate predictions lead directly to a healthier business: * Improved Cash Flow: You buy only what you need, which frees up cash for marketing, product development, and growth. * Higher Customer Satisfaction: Keeping your bestsellers in stock creates a smooth, reliable experience that builds loyalty and drives repeat business. * Smarter Marketing Spend: When you know which products are about to pop, you can align your ad campaigns to maximize your return on ad spend (ROAS).

This is where the forecast accuracy formula comes into play. These formulas are the practical tools that turn fuzzy guesswork into a reliable, data-driven strategy. They give you a hard number—a clear score—that quantifies your prediction error. This lets you track performance, pinpoint weaknesses, and make tangible improvements.

Achieving top-tier inventory performance, fueled by precise forecasts, unlocks serious financial advantages. Understanding the true cost savings of automated inventory control, for example, really drives home why accuracy is so crucial for boosting your ROI.

As we'll dig into next, different formulas tell different stories about your performance, helping you focus on what really matters for your store. To dive deeper into refining your predictions, check out our guide on improving demand forecast accuracy.

Jumping into forecast accuracy formulas can feel like you’re cracking open a dense statistics textbook. But they're not nearly as scary as they seem.

At their core, these formulas are just simple tools designed to answer one crucial question: "How wrong was my guess?" Each one gives you a slightly different angle on your forecasting performance, helping you sharpen your inventory decisions.

Think of it like getting feedback on a project. One person might give you a simple percentage score. Another might zero in on your single biggest mistake. A third might weigh their feedback based on what mattered most. Each perspective is valuable, and the same goes for these formulas.

Before we get into the math, let's quickly touch on why this is so critical for your store's health.

As you can see, bad forecasting is a direct line to overstock, stockouts, and stalled growth—the three horsemen of inventory apocalypse for any Shopify merchant.

To make things easier, here's a quick rundown of the most common metrics we'll be covering. Think of this table as your cheat sheet for choosing the right tool for the right job.

| Metric (Formula) | Best For | Key Advantage | Potential Drawback |

|---|---|---|---|

| MAPE | Getting a simple, high-level "grade" on overall accuracy that's easy to compare across all products. | Intuitive percentage format makes it universally understandable. A 15% MAPE means you're off by 15%, on average. | Can be misleading for low-volume items where a small error creates a huge percentage swing. |

| RMSE | Protecting your bestsellers or high-stakes items where large forecasting errors are catastrophic. | Heavily penalizes large errors, acting as an "alarm bell" for mistakes that could lead to major stockouts. | Less intuitive than a percentage; the value itself doesn't have a direct business meaning. |

| WAPE | Measuring accuracy for your entire catalog while giving more weight to the products that actually drive revenue. | Focuses on the business impact of errors by weighting them by sales volume. Solves MAPE's low-volume issue. | Can hide persistent issues with smaller, "long-tail" SKUs since their errors have less impact on the total score. |

Each of these formulas tells a different story about your forecast's reliability. Now, let's break down how they actually work and when you should pull them out of your toolkit.

Mean Absolute Percentage Error, or MAPE, is probably the most popular kid on the block. It measures the average size of your errors as a percentage, which makes it incredibly easy to understand and compare across different products, no matter their price or sales volume.

Let's say you sell a $10 soap and a $100 skincare set. If your forecast for each is off by 10 units, the raw error is identical. But the impact couldn't be more different. MAPE puts this into perspective.

MAPE = (1/n) * Σ |(Actual - Forecast) / Actual| * 100%

A MAPE of 15% means that, on average, your forecast deviates from actual sales by 15%. This universal "grading system" lets you say, "My soap forecast is 10% off, but my skincare set is 25% off," giving you a clear, apples-to-apples comparison.

This isn't just theory. A long-term study of retail data found that using the right forecasting models could slash MAPE by up to 15-20% during peak seasons. That's a massive improvement, driven by a better understanding of percentage error. You can discover more about these retail forecasting findings and how they apply to your store.

While MAPE gives you a nice overall grade, Root Mean Square Error (RMSE) is your high-stakes alarm bell. It’s built to heavily penalize large, costly errors, making it the perfect watchdog for your most important products.

Here's the trick: the formula squares the difference between actual and forecasted sales. This simple bit of math means small errors barely move the needle, but large errors get magnified—a lot. An error of 10 units becomes 100, while an error of 2 becomes just 4.

RMSE = √ [ Σ(Actual - Forecast)² / n ]

Think of RMSE as your "bestseller protector." For a product that drives a huge chunk of your revenue, a major stockout isn't just a mistake; it's a disaster. RMSE will scream loudly if your forecast for that hero product is way off, forcing you to pay attention to the errors that can truly tank your business.

Weighted Absolute Percentage Error (WAPE) is the savvy strategist in this group. It gets a fundamental rule of e-commerce: not all products are created equal. A 20% error on a fast-mover has a much bigger financial impact than a 20% error on a slow-selling item.

WAPE (sometimes called the MAD/Mean Ratio) elegantly solves one of MAPE’s biggest flaws. MAPE can get thrown off by low-volume products where a tiny unit error creates a ridiculously high percentage error. WAPE fixes this by weighting each error based on its actual sales volume.

WAPE = Σ |Actual - Forecast| / Σ Actual * 100%

Here’s how it works in plain English: * First, it adds up all the absolute errors (in units). * Then, it divides that total by the sum of all actual sales (in units).

This simple but powerful tweak means products with higher sales volumes have a much bigger say in the final accuracy score. An error on an item that sells 1,000 units a month will hit your WAPE score way harder than the same error on an item that sells only 10 units. It naturally guides you to focus your energy on the SKUs that actually drive your business forward.

Ultimately, these formulas aren't just for calculating a score. They're for gaining insight. Understanding what each one is telling you helps you build a more resilient supply chain, sidestep costly inventory blunders, and make smarter decisions. And remember, good forecasting is just one piece of the puzzle. You can learn more about protecting your business from uncertainty in our guide on how to calculate safety stock.

Theory is one thing, but seeing a forecast accuracy formula work its magic with real numbers is where the lightbulb really turns on. Abstract concepts like percentages and squared errors suddenly become powerful business tools when you apply them to a practical scenario.

Let's bring these formulas to life with a fictional Shopify store, "Artisan Bean Co.," to see how they perform in the wild.

Imagine Artisan Bean Co. wants to review the forecast performance for its top-selling product: the "Morning Ritual" Medium Roast. They pull their sales data from the past four weeks to see how their predictions held up against what customers actually bought.

Here's the data they're working with:

| Week | Forecast (Units) | Actual Sales (Units) |

|---|---|---|

| Week 1 | 200 | 250 |

| Week 2 | 220 | 210 |

| Week 3 | 240 | 300 |

| Week 4 | 260 | 250 |

At first glance, the numbers look a bit mixed. Some weeks they under-forecasted, and others they were pretty close. But to make smart decisions about ordering and cash flow, they need to quantify the error.

First up is MAPE, the universal report card. It gives us the average percentage error across the four-week period, providing a simple, high-level score that’s easy to grasp.

To get our final MAPE score, we first need to find the absolute percentage error for each week.

Now, we just average those weekly percentages: (20.0 + 4.8 + 20.0 + 4.0) / 4 = 12.2%

Result: Artisan Bean Co.'s MAPE is 12.2%. This means, on average, their forecast for the "Morning Ritual" roast was off by about 12%. It's a solid, straightforward number they can use to benchmark this product's forecast against others.

Next, let's run the numbers for RMSE. Remember, this is the metric that sounds the alarm on big mistakes. It's designed to heavily penalize large errors, telling us if any single week's miss was particularly damaging.

First, we calculate the squared error for each week:

See what happened there? The huge 60-unit error in Week 3 ballooned into a massive 3600, while the smaller 10-unit errors barely made a dent. That’s RMSE doing its job perfectly.

Now, we find the average of these squared errors and then take the square root: √ [(2500 + 100 + 3600 + 100) / 4] = √ [6300 / 4] = √1575 ≈ 39.7

The RMSE is 39.7 units. While this number isn't as intuitive as a percentage, its message is loud and clear: that big miss in Week 3 is a major problem. If this product was prone to stockouts, that single week could have cost them dearly in lost sales and customer trust.

Finally, let's look at WAPE. This metric really shines when you're evaluating a whole category or even the entire store, as it weighs errors by sales volume. For our single product example, the result will look a lot like MAPE, but the calculation method is key.

We start by summing the absolute errors and the actual sales:

Now, we just divide the total error by the total sales: (130 / 1010) * 100% ≈ 12.9%

The WAPE comes out to 12.9%. This tells us the total error was about 13% of the total sales volume for this product. If we were analyzing multiple SKUs, WAPE would ensure that the errors from a high-volume hero product like "Morning Ritual" have a much bigger impact on the final score than a niche, slow-selling herbal tea.

By running these calculations, Artisan Bean Co. moves from a vague feeling of "we were a bit off" to a precise, actionable understanding of their performance. They know their average error (MAPE), they see the impact of their biggest mistake (RMSE), and they have a framework for evaluating business-wide impact (WAPE). This is the power of a good forecast accuracy formula.

Picking a forecast accuracy formula isn't a simple plug-and-play decision. The right metric for your brand depends entirely on your business model, your product catalog, and the unique challenges you're trying to solve. Moving beyond textbook definitions and into real-world strategy is what separates good inventory management from great.

Think of it like a car's dashboard. The speedometer tells you how fast you're going, the fuel gauge shows your range, and the oil light warns you of engine trouble. You wouldn't rely on just one of those to understand your car's health, right? The same logic applies to your forecasting metrics—each one tells a different, crucial part of the story.

The ideal formula has to align with your store’s DNA. A fast-fashion brand juggling unpredictable, seasonal hits needs a metric that can handle volatility and compare performance across products with wildly different sales patterns.

On the other hand, a supplements store with steady, high-volume sellers should be laser-focused on metrics that prioritize its biggest revenue drivers.

Here’s how different business types might think about this: * Fast-Fashion or Seasonal Brands: These stores live and die by intermittent demand and constant new product drops. A metric like Mean Absolute Scaled Error (MASE) is a game-changer here. It compares your forecast's error to a simple "naive" forecast, which gives you much-needed context for those volatile, hard-to-predict products. * High-Volume, Stable Product Stores: For businesses selling staples like coffee or supplements, Weighted Absolute Percentage Error (WAPE) is king. It smartly weights accuracy by sales volume, forcing you to pay the most attention to the bestsellers that actually move the needle on revenue and cash flow.

The biggest trap merchants fall into is relying on a single, all-purpose metric. This creates dangerous blind spots. For instance, MAPE goes haywire during periods of zero sales (you can't divide by zero) and can make tiny errors on slow-movers look like massive percentage failures.

A "forecasting dashboard" approach is a much smarter strategy. By tracking a few key metrics together, you get a complete picture of your performance. This allows for nuanced, intelligent decisions that give you a serious competitive edge.

A number without context is just noise. But what if that number could help you slash inventory costs by 15-25% within a year? That’s the real-world impact of nailing the right forecast accuracy formula.

For high-stakes retail with choppy demand, like food and beverage SKUs on Shopify, a metric like Root Mean Squared Error (RMSE) is perfect because it heavily penalizes large, costly errors. Nestlé reported a massive 40% error reduction by using RMSE-evaluated models. Another retailer rocketed from 24% to 76% accuracy—a 217% leap—by blending historical sales with external signals.

These examples show how picking the right formula for your specific situation can unlock huge savings and efficiency. You can read more about these retail forecasting advancements and see just how powerful this can be.

So, what should your dashboard actually include? For most Shopify stores, this combination is a powerhouse:

Using a mix of these formulas helps you move beyond just measuring error to truly understanding it. This deeper insight is what allows platforms like Tociny.ai to generate such precise, actionable inventory plans. The platform doesn't just spit out a single score; it analyzes multiple dimensions of forecast error to help you cut overstock, eliminate stockouts, and plan your inventory with total confidence.

Calculating your forecast error is a bit like stepping on a scale. It gives you a number, but the real work starts after you see it. Knowing you have a 15% MAPE is a crucial starting point, but actively driving that number down is how you build a more resilient, profitable business. The goal isn't just to measure; it's to improve.

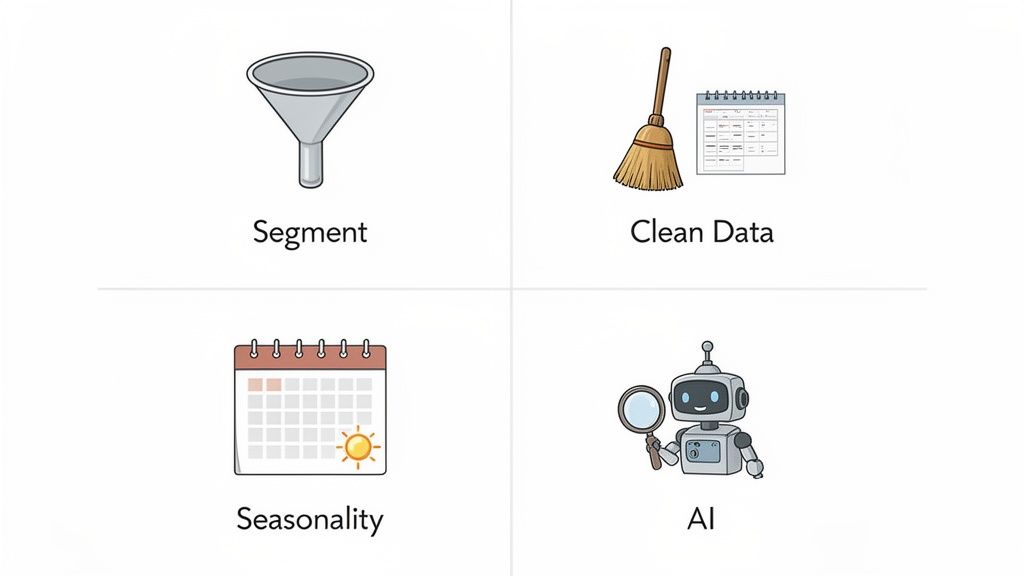

Luckily, boosting your forecast accuracy isn't about finding some mythical silver bullet. It's about putting smart, systematic strategies in place to clean up your data, add critical context, and focus your energy where it actually counts. These techniques turn forecasting from a passive report card into a proactive tool for growth.

Let's be real: not all products are created equal. A 20% forecast error on your top-selling hero product is a five-alarm fire. That same error on a slow-moving, long-tail item? It might barely make a ripple. This is exactly where ABC analysis comes in.

This classic inventory technique segments your products based on their value to your business:

By bucketing your SKUs this way, you can dedicate more rigorous forecasting methods and closer monitoring to your A-Items, where accuracy has the biggest impact on your bottom line. It’s a textbook application of the Pareto Principle, ensuring your most valuable resources—your time and attention—are spent protecting your most valuable assets. You can find more strategies for managing your product catalog in our complete guide to inventory optimization techniques.

Your historical sales data is the foundation of any forecast. If that foundation is cracked with messy, misleading information, the whole structure will be wobbly. One-off events can create massive, unrepresentative spikes or dips in your data that will throw any model completely off track.

An uncleaned dataset is like trying to navigate with a broken compass. It will point you in a direction, but it's almost certainly the wrong one. Cleaning outliers ensures your forecast is based on true customer behavior, not random noise.

Common outliers you should look for and scrub include:

Isolating and either removing or adjusting these data points before you run your forecast will give you a much more realistic and reliable prediction. Beyond the formulas themselves, effective forecasting impacts various key business metrics. Understanding tools like a conversion rate calculator can help analyze past performance, which in turn can inform future forecasting efforts and improve the accuracy of sales and revenue predictions.

A forecast based purely on past sales is operating in a vacuum. It assumes the future will look exactly like the past, and in e-commerce, that's almost never true. To get to the next level of accuracy, you have to bring in external factors and forward-looking business intelligence.

This means enriching your data with crucial context, such as:

Trying to manually track these variables for hundreds of SKUs is next to impossible. This is where AI-powered platforms like Tociny.ai deliver a massive advantage. Our system can analyze thousands of data points at once—from historical sales patterns to market trends—to spot hidden connections and automatically adjust your forecasts. It turns a complex, time-consuming analytical chore into an automated, precise, and responsive demand plan.

Even after you get a handle on the formulas, the real questions pop up when you try to apply all this to your actual Shopify store. Getting straight, practical answers is the key to making forecast accuracy formulas work for you, not against you. It's how you avoid the common traps that snag even experienced merchants.

This section cuts through the noise and tackles the most frequent questions we hear from e-commerce owners. We'll give you the insights you need to turn measurement into meaningful action.

This is the million-dollar question, isn't it? The truth is, it's less about a single magic number and more about your specific business and the goal of getting better over time.

While there’s no universal benchmark that fits every single industry, a common goal for products with steady, predictable demand is 80-85% accuracy. This means your error rate (using something like MAPE or WAPE) is sitting between 15-20%.

But let's be realistic. If you're in a more volatile space like fast fashion or selling products with massive seasonal swings, chasing 85% might just drive you crazy.

For those trickier categories, hitting 60-70% accuracy is a genuinely solid achievement. The real goal isn't perfection; it's progress. Start by figuring out your baseline today, then set a realistic target to chip away at that error rate, maybe by 5-10% each quarter.

The right rhythm for measuring accuracy really depends on your business's pulse and how quickly your inventory turns over. You want a schedule that helps you spot trends without getting whiplash from every tiny daily or weekly blip.

Here’s a simple way to think about it: * Monthly Review: For most Shopify stores, checking in once a month is the sweet spot. It gives you enough data to see real patterns emerge and lets you make smart, strategic adjustments to your purchasing. * Weekly Review: If you're selling fast-moving consumer goods (FMCG) or you have incredibly short lead times from your suppliers, a weekly check-in might be a necessity. It keeps you nimble and helps you dodge stockouts.

The single most important thing? Be consistent. Whatever cadence you choose, stick to it. That discipline is what allows you to actually track your improvement and see if the changes you're making are paying off.

Look, a simple moving average is often the first tool merchants reach for. For products with super stable, flat-as-a-pancake demand, it can be a decent starting point. But for the vast majority of e-commerce brands, it has some massive blind spots that make it unreliable.

A moving average is purely reactive. It’s always looking in the rearview mirror, which means it lags behind trends and completely misses the memo on seasonality.

This flaw means it will consistently under-forecast when demand is picking up and over-forecast when it's dropping off. You'll find yourself stuck in a frustrating cycle of stocking out on winners and being buried in products nobody wants anymore.

More sophisticated methods, like exponential smoothing or AI-powered models, are built for the real world of e-commerce. They’re designed to adapt to the messy complexities of trends, seasonal spikes (hello, Black Friday), and shifting customer tastes. The result is a much more reliable prediction and, ultimately, a healthier bottom line.

Ready to move beyond guesswork and manual spreadsheets? Tociny.ai uses advanced AI to analyze your sales data, identify patterns, and generate precise, actionable demand forecasts. Stop reacting and start planning with confidence. Get early access to Tociny.ai today.

Tociny is in private beta — we’re onboarding a few select stores right now.

Book a short call to get early access and exclusive insights.