When a customer lands on your product page, card in hand, ready to click "Buy Now," the last thing you want them to see is "Out of Stock."

That moment is a stockout. It’s more than a minor inconvenience or a simple supply chain hiccup; it’s a critical failure right at the finish line of the customer journey. For any Shopify or D2C brand, it’s a direct hit to your sales and your reputation.

Let's reframe this. A stockout isn't just an inventory problem—it's a customer experience problem.

Imagine someone sees your latest Instagram ad, gets excited, and rushes to your store to buy. They've done everything you wanted them to. But when they get there, the product is gone. That jarring experience is the true meaning of a stockout. It’s a broken promise you made to an eager customer at their peak moment of interest.

Think of your best-selling product as the year's most anticipated concert. Your marketing is the hype machine, getting everyone excited. Your customers are the fans, showing up with money in hand, ready for an amazing experience. A stockout is like them getting to the front of the line only to see a huge "SOLD OUT" sign.

What happens next is predictable and painful:

This isn't just a delayed purchase. For many shoppers, it's a permanently redirected one. Research consistently shows that when faced with a stockout, over 30% of shoppers will immediately buy from another brand.

That single missed sale often turns into a lost customer for good. The ripple effect damages your brand perception, erodes loyalty, and puts a hard ceiling on your growth.

It’s easy to think a stockout just means you missed one sale. If only it were that simple.

The reality is that an empty shelf—whether physical or digital—sets off a chain reaction of hidden costs that quietly eats away at your profits. The obvious hit is the immediate lost revenue from that one item, but the real damage goes much, much deeper.

Think about the ad spend that brought that customer to your product page in the first place. Every dollar you spent on that Google Shopping or Meta campaign is completely wasted the second they see "Out of Stock." Your marketing budget, designed to drive sales, ends up funding a dead-end customer experience. That's a direct hit to your ROI.

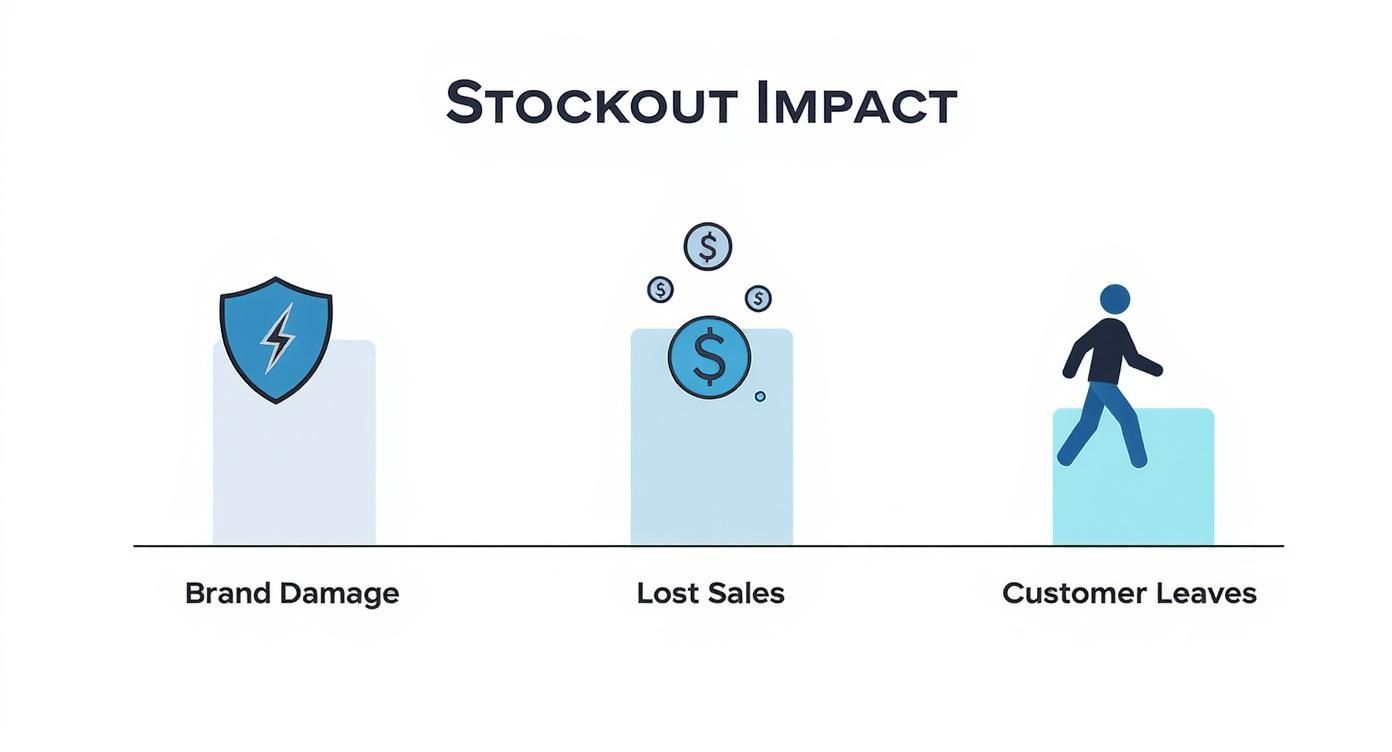

This diagram paints a clear picture of how a single stockout event can spiral, impacting everything from your bottom line to your brand's reputation.

As you can see, the initial lost sale is just the tip of the iceberg. The real threats—brand damage and customer churn—are what cause the most severe, long-term consequences for your business.

The financial damage doesn't stop when the customer clicks away. It compounds. When shoppers can't get what they want from you, they don’t just patiently wait—they head straight to your competitor. One study found that over 30% of shoppers will immediately buy from another brand if they encounter a stockout.

This creates some serious long-term problems:

The total cost of a stockout isn’t just the price of the item; it’s the initial sale, plus all future sales from that customer, plus the sales lost from anyone they discouraged.

To truly grasp the scale of the damage, let's break down the numbers with a concrete example for a D2C brand.

Here’s a look at how the direct and indirect costs add up from a single stockout on a popular product.

| Cost Category | Description | Example Financial Impact |

|---|---|---|

| Direct Lost Revenue | The most obvious cost: the price of the item you couldn't sell. | $50 |

| Wasted Ad Spend | The cost to acquire the customer who couldn't purchase (Cost Per Acquisition). | $15 |

| Lost Future Sales (CLV) | The potential lifetime value of a customer who churns after a bad experience. | $250 |

| Operational Costs | Time your team spends responding to "when will this be back in stock?" emails. | $10 |

| Reputational Damage | Harder to quantify, but negative reviews can deter dozens of future customers. | >$100s |

| Total Estimated Cost | The combined financial hit from a single stockout event. | ~$425+ |

As the table shows, a simple $50 stockout can easily cost your business over $425 when you factor in all the ripple effects.

These hidden costs often don't show up on a standard profit and loss statement, but they are just as real as your direct expenses. They're a lot like another sneaky expense you can learn about in our guide to what is inventory carrying cost. Getting a handle on both is non-negotiable for building a healthy, profitable brand.

Stockouts almost never happen by accident. They're usually the final, painful symptom of a deeper operational problem that's been brewing under the surface until a product page suddenly flashes "Out of Stock." Getting to the bottom of why it's happening is the only way to build a more resilient inventory system.

Most of these issues fall into two big buckets: problems with demand planning (how you predict what customers will buy) and disruptions in supply execution (how you get that product onto your shelves). Figuring out which one is tripping you up is the key to finding a fix that actually works.

By far, the most common culprit behind a stockout is simply underestimating how much your customers want something. This is a classic trap for brands relying on old-school methods or incomplete data, leaving them completely flat-footed when buying habits change.

Here are a few ways forecasting can go wrong:

Even if your demand forecast is dead-on, your inventory plan can still get wrecked by problems on the supply side. These issues are often out of your direct control, which is exactly why having a backup plan is so critical.

A stockout is the final, visible outcome of a series of smaller, often invisible, failures in forecasting, communication, and supply chain management. Addressing the root cause prevents the symptom from reappearing.

These are the supply chain weak spots to watch for:

The real secret to building a resilient e-commerce brand is moving from a reactive, “out-of-stock” panic to proactive control. Instead of scrambling when a product runs low, you can put a few core strategies in place to stay ahead of the curve and keep your digital shelves full. The goal is simple: build a system that anticipates what your customers want long before they see that dreaded “sold out” button.

This whole approach starts with a solid grasp of your sales patterns and supply chain realities. It’s all about creating smart buffers and automated triggers that kick in way before a stockout even becomes a threat.

The single most effective way to prevent a stockout is to know what’s coming. You’ll never predict the future with 100% accuracy, but you can get remarkably close by digging into your own data.

Good demand forecasting isn’t a wild guess; it’s a calculated look at a few key data points:

By weaving these elements together, you’ll paint a much clearer picture of how much stock you actually need, sidestepping the common mistake of simply underestimating your customers' excitement.

Even the best forecast can get thrown off course. A random supplier delay, a sudden shoutout from an influencer, or a shipping mishap can happen to anyone. This is where safety stock becomes your best friend. It’s a calculated buffer of extra inventory you keep on hand specifically for these “just in case” moments.

Think of safety stock as the reserve fuel tank for your business. You don’t tap into it for your daily commute, but it’s there to save you if the journey takes an unexpected turn, keeping you from getting stranded.

Finding the sweet spot is key. Too little, and you risk stocking out anyway. Too much, and you’re tying up precious cash in dusty boxes. The trick is to calculate it based on your sales velocity and supplier lead times, making sure your buffer is just right. For a deeper dive, check out our complete guide on how to calculate safety stock in inventory.

Finally, your inventory system needs an automatic alarm bell that tells you exactly when it's time to restock. That's your reorder point—the specific inventory level that, once hit, triggers a new purchase order. Setting this correctly ensures fresh inventory arrives right as you’re about to dip into your safety stock.

This strategy is supercharged when you have strong supplier relationships. Keep the lines of communication wide open so you’re the first to know about potential production hiccups. When you have reliable partners who give you clear lead times, your reorder point calculations become incredibly accurate, creating a smooth and dependable replenishment cycle.

Choosing the right mix of strategies depends on your business. Here’s a quick comparison to help you decide where to focus your efforts.

| Strategy | Best For | Implementation Complexity |

|---|---|---|

| Demand Forecasting | Businesses with seasonal products or predictable sales patterns. | Medium |

| Safety Stock | Any business wanting a buffer against unexpected demand or delays. | Low |

| Reorder Points | Businesses looking to automate their replenishment process. | Medium |

| Supplier Management | Brands that rely on a few key suppliers for critical products. | Low to Medium |

Ultimately, the best approach often combines all these elements into a cohesive system. Forecasting tells you what's coming, safety stock protects you from the unexpected, and reorder points automate the entire process, ensuring you're always prepared.

While manual forecasting and safety stock spreadsheets are a great start, they have their limits. Let’s be honest, they often can't keep up with the sheer speed and complexity of modern e-commerce. This is exactly where artificial intelligence steps in, not to replace you, but to act as an incredibly sharp co-pilot for your inventory planning.

AI-powered platforms like Tociny.ai are built to crunch thousands of data points at once. They go way beyond your past sales history, weaving in variables like current market trends, competitor moves, and even promotional schedules to generate demand forecasts with incredible accuracy. This data-first approach helps you sidestep the common forecasting errors that inevitably lead to stockouts.

Instead of relying on gut feelings and last year's numbers, AI gives you precise, actionable recommendations for every single SKU in your catalog. It’s about shifting your entire operation from reactive scrambling to proactive control.

Think of an AI inventory tool as an expert analyst who never sleeps. It’s constantly watching your sales velocity, supply chain lead times, and market signals to figure out the perfect amount of inventory you need at any given moment.

An AI platform can automatically handle the heavy lifting:

Achieving this level of detail manually is nearly impossible, especially as your store grows and your catalog expands. By automating these complex calculations, AI frees you up to focus on the bigger picture—strategy, marketing, and growth—all while knowing your inventory decisions are backed by solid data.

Of course, it helps to understand what's going on under the hood. You can explore the different ways these predictions are made in our guide to demand forecast methods.

When you're in the trenches of running a D2C brand, a few common questions about stockouts always seem to pop up. Let's tackle them head-on so you can get back to managing your inventory with confidence.

While the dream is a perfect 0%, that’s not always realistic. A good benchmark for most e-commerce brands is to keep your stockout rate between 2% and 5%.

But this isn't a one-size-fits-all number. For your best-selling "hero" products—the ones that drive the bulk of your revenue and keep customers coming back—you should aim for as close to 0% as humanly possible. A stockout on these items hurts the most.

For your slower-moving items, you can afford a little more breathing room. The real goal is to track this metric for every single SKU and constantly work on improving it across the board.

It's a simple but crucial distinction.

A stockout means the product is completely gone. The "Add to Cart" button is greyed out, and the customer has nowhere to go but to a competitor. It’s a dead end, and almost always a lost sale.

A backorder, on the other hand, is a proactive strategy. You let customers purchase an out-of-stock item on the promise that you'll ship it as soon as it's available.

Backorders can definitely save a sale that a stockout would lose. But tread carefully—if you aren't crystal clear about shipping delays or if the wait is too long, you can still end up with an unhappy customer and a damaged reputation.

Safety stock is your best friend for reducing stockouts. It's an incredible buffer against everyday chaos like a sudden spike in demand or a small hiccup with your supplier. It dramatically lowers your risk.

But it can't prevent stockouts entirely.

Think about the big, unpredictable events: a massive port closure, your main supplier suddenly going out of business, or a product going viral on TikTok overnight. These kinds of disruptions can wipe out your entire inventory, safety stock included. See it as a powerful risk-reduction tool, not an invincible shield.

Ready to move from reactive scrambling to proactive inventory control? Tociny.ai uses AI to analyze your sales data, predict future demand, and provide clear recommendations to keep your products in stock and your customers happy. Start making smarter inventory decisions today.

Tociny is in private beta — we’re onboarding a few select stores right now.

Book a short call to get early access and exclusive insights.